Economy

U.S. Election: Promises, Policy, and the Potential Effects on the Economy and Corporate Credit

S&P Global Ratings analyzed the platforms of President Donald Trump and the Republican party, and Democratic nominee Joe Biden and his party. Among the areas Ratings looked at, the biggest differences were on taxes, fiscal stimulus, regulation, and immigration, while Ratings saw surprising similarities on trade and infrastructure. Given that the U.S. economy is mired in a weak recovery, Ratings believes the single most important task the next president has will be to create jobs, given the unemployment rate is still high, at 7.9%--above or equal to the peak of eight of the past 11 recessions.

U.S. Election Likely to Have Minor Impact on Consumer Spending – survey

The U.S. presidential election in November is expected to have a minor impact on consumer discretionary spending over the next three months but the coronavirus crisis continues to weigh heavily on people's minds and purchasing decisions, according to a new survey by 451 Research, an offering of S&P Global Market Intelligence.

Read the Full ArticleU.S. Recovery Flashing Warning Signs Ahead of Last Jobs Report Before Election

The U.S. jobs recovery faces a double drag from the persistence of the pandemic and a lack of additional federal stimulus as the government is set to report the last official unemployment that rate voters will see before the election.

Read the Full ArticleCorporate Credit

How Diverging Energy Policies in the U.S. Presidential Election May Affect Credit Quality

The tenets of President Donald Trump's and former-Vice President Joe Biden's energy platforms are in stark contrast to each other and could have vastly different outcomes.

Trump supports promoting U.S. energy, protecting energy tax subsidies, increasing use of federal lands/waters for drilling, reducing regulatory hurdles for infrastructure spending, rolling back clean air emission standards, and eliminating methane gas emission regulations; a Trump re-election would likely result in more of the same. Biden's energy plan is more focused on reducing dependence on fossil fuels, protecting the environment, reducing greenhouse gas (GHG) emissions, and eliminating tax subsidies for fossil fuel producers.

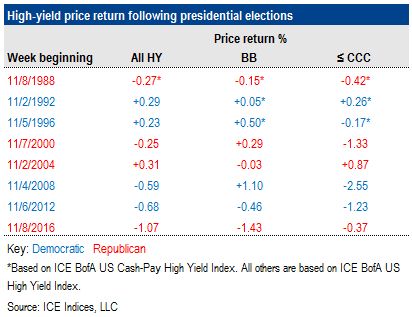

Too Close to Call—The Impact of Election Results on High-Yield Returns

This analysis explores two aspects of the upcoming election. First is the historical record of the immediate price impact of the outcome, with a focus on which party's candidate emerges victorious. The second focus is historical high-yield returns by party during presidential returns.

How A Big Election Win For The Democrats Could Affect U.S. Telecom And Cable Companies

S&P Global Ratings believe the biggest risk is the potential for price regulation of cable providers, while the potential for increased funding for broadband provides some opportunities for operators to benefit.

Read the Full Article

Tax Policy

U.S. Corporate Tax Policy Post-Election Won’t Likely Affect Ratings, Regardless of Election Results

The plan espoused by Democratic presidential candidate Joe Biden to raise the statutory tax rate for U.S. corporations would likely raise the effective rate for most companies S&P Global Ratings rates, absent tax-planning offsets.

Ratings expects companies and sectors with large overseas earnings would likely see even bigger increases in effective tax rates as more comprehensive taxation of foreign earnings would compound the effects of the domestic tax rate increase.

U.S. Regulated Utilities' Credit Metrics Could Strengthen Under Proposed Biden Tax Plan

The espoused tax plan of U.S. Democratic presidential candidate Joe Biden would likely improve the U.S. regulated utility industry's financial measures if implemented.

Read the Full ArticleConsumer Companies Paid Lower Tax Rates Under Trump, Could See Hikes with Biden

Corporate taxes dropped for consumer companies, among others, following the passage of the 2017 tax reforms championed by President Donald Trump. A Joe Biden presidency, meanwhile, promises to roll back many of the Trump tax cuts while keeping rates below where they sat under previous administrations.

Read the Full ArticleA complimentary webinar for financial advisors. History suggests that sectors have a greater potential to over- and underperform during U.S. presidential election years, but finding the right sector candidates to endorse can be challenging.

Register for the WebinarTech

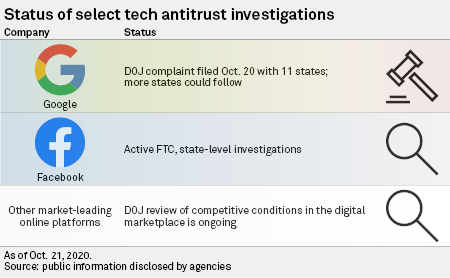

What a Biden Administration Might Mean for DOJ's Antitrust Case Against Google

The Trump administration launched its antitrust legal challenge against Alphabet Inc.'s Google LLC this week, but policy experts say federal antitrust legal scrutiny will likely rage on regardless of the election results this November. The U.S. Justice Department filed an antitrust lawsuit against Google on Oct. 20 alleging that the company unlawfully maintained monopolies in the general search, search advertising and general search text advertising markets through "anticompetitive and exclusionary practices."

Biden Would Offer Stable, Tech-Focused Future for Auto Industry–Experts

A Joe Biden presidency would give the auto industry a more stable future focused on forward-looking technology like electrification and autonomous driving, while a continuation of the Donald Trump presidency would push for more traditional car manufacturing in the U.S., experts say.

Read the Full ArticleEarnings Hit from Biden Tax Hike Seen Offset by Stimulus if Dems Sweep Congress

Democratic presidential nominee Joe Biden's plan to raise corporate tax rates should he win the White House might not be so bad for the stock market, as long as Democrats gain control of both houses of Congress as well.

That would allow him to push through a larger stimulus bill than is likely under either a second term for President Donald Trump or a split Congress alongside a President Biden, economists and analysts told S&P Global Market Intelligence.

Read the Full Article

Capital Markets

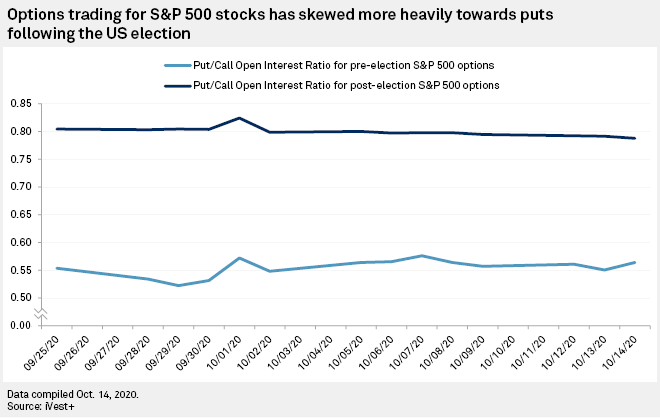

Hedging Costs Surge as Investors Brace for Uncertain Election Outcome

Investors are having to get more creative with their election hedging strategies. With the cost of put options on the S&P 500 as much as 50% more expensive than a month ago, those concerned over the potential for the election to disrupt markets are considering a number of different trades, said Michael Schwartz, chief options strategist with Oppenheimer & Co. "It's all anyone wants to talk about," Schwartz said of conversations he has had with his clients over the past two months.

S&P 500 Points to Tight U.S. Election, if History is a Guide

Since 1944, the outcome of the U.S. presidential election could be predicted with a high level of confidence by looking at the performance of the S&P 500 over the three months preceding polling day.

Read the Full ArticleSectors and Electors

Markets expect elevated volatility surrounding the U.S. Presidential election, now just six weeks away. The VIX futures curve currently peaks in November, but as long ago as April a close observer could detect expectations of electoral volatility. Increased volatility may create an unusual opportunity for sector allocators.

Read the Full ArticleBiden Victory Seen Weighing on Dollar Already at 2.5-Year Low

Democratic presidential nominee Joe Biden could end up getting the weak dollar that President Donald Trump craved for much of his first term in office.

Read the Full ArticleOil & Gas

Wide Range of Energy Market Impacts at Play in Race for White House

Stakes are high across the US energy and commodities sectors as President Donald Trump and former Vice President Joe Biden volley to shape energy, climate and trade policy for the next four years. Biden has called for a swift pivot to clean energy while Trump makes the case for the country's abundant fossil fuel resources. The winner – who may not be known immediately after the Nov. 3 election – will control regulations that could stymie or accelerate growth across energy sectors and markets and help to direct investment. For oil, natural gas, petrochemicals and metals, trade policy also looms large in the election stakes, after Trump's chaotic trade policies reshaped commodity flows.

Biden has proposed an aggressive plan to boost clean energy and reduce emissions to combat global warming, while Trump gives little attention to the issue in his "energy dominance" agenda emphasizing fossil fuel-fired generation. Coal's competitive position would be starkly challenged under either administration, although the election could determine whether strict regulations on mines and power plants are reinstated.

The energy transition underway has already taken its toll on the coal industry. More than 41.5 GW of coal-fired generation has been retired during the Trump administration, while nearly 46 GW of wind and solar projects have come online in that same time frame from 2017 to mid-2020, according to data compiled by S&P Global Platts Analytics. Platts Analytics' expectations for the next few years include a brief rebound in coal and pullback in natural gas, while renewable generation continues to march upwards.

Political Polarization Creating Regulatory 'Ping-Pong Effect' for U.S. Energy

As the US political climate has grown more polarized, the energy sector has faced increasingly significant shifts on the regulatory front every four to eight years, and the industry may have to ready itself for another pendulum swing after the November presidential election.

Read the Full ArticleResults in Down-Ticket Races Provide Energy Industry Some Election Certainty

While federal-level election results remained uncertain the morning after the Nov. 3 U.S. election, a number of state-level races and ballot initiatives with energy industry impacts had been decided.

Read the Full ArticleHost of Energy Issues Settled, but Counting Continues for President

The winner of the White House and control of the US Senate remained unknown early Nov. 4 as mail-in ballots continued to be counted, but implications for energy and commodity markets unfolded in local and state races across the country.

Read the Full ArticleEying Pennsylvania, Trump Officials Pound on Energy Themes

The Trump administration is hoping that a pro-drilling message will give it an edge in the tight race for Pennsylvania votes, with top officials visiting the state and campaign surrogates pouncing on Democratic challenger Joe Biden's comments about transitioning away from oil.

Read the Full Article

Energy Transition

Pace of Energy Transition, Innovation on the Ballot in Presidential Election

The US appears headed for a clean energy future regardless of who sits in the White House. But the pace of the energy transition – and presumably the severity of ensuing climate change impacts – could look dramatically different depending on the victor of the Nov. 3 presidential election.

The combative presidential campaigns have put Democratic nominee and former Vice President Joe Biden square in the clean energy camp, with President Donald Trump making the case for the country's abundant fossil fuel resources.

The energy transition underway has already taken its toll on the coal industry. More than 41.5 GW of coal-fired generation has been retired during the Trump administration, while nearly 46 GW of wind and solar projects have come online in that same time frame from 2017 to mid-2020, according to data compiled by S&P Global Platts Analytics. Platts Analytics' expectations for the next few years include a brief rebound in coal and pullback in natural gas, while renewable generation continues to march upwards.

Biden Plan to Make Companies Disclose Climate Risks Key to Decarbonization

Democratic presidential candidate Joe Biden has pledged to make publicly traded companies disclose their climate risks and emissions levels, a move experts say could help companies, investors and regulators make better-informed decisions and pursue decarbonization targets.

Read the Full ArticlePotential Split U.S. Government Puts Energy Policy in Agencies' Court

With major national election outcomes still in flux Wednesday morning, energy lobbyists and policy analysts were parsing the potential for divided government to dampen energy policy shifts, even if Democratic presidential contender Joe Biden ultimately prevailed.

Read the Full ArticleBiden Victory Could Push Mexico Closer Toward Green Energy

If Joe Biden wins the U.S. presidency in November, he could hasten the country's migration to more renewable energy by enforcing the Paris Agreement and the energy chapter under the U.S.-Mexico-Canada Agreement. Should this happen, Mexico may have to rethink its own current hydrocarbon-focused energy strategy.

Read the Full ArticleClimate Action

Results Show Deeper Divide on Energy Issues, Tough Path for Tackling Climate

While control of the White House and US Senate waits for ballot counters, a host of implications for energy and commodity markets from the Nov. 3 elections unfolded across the country, revealing a deepening US divide on energy issues that will make it harder to pursue federal policy on decarbonization and mitigating climate change.

In statewide ballot measures, Texas voters rejected tougher limits on natural gas flaring, New Mexicans revamped utility oversight, Nevada voters appeared set to adopt a 50% renewable power mandate by 2030, and Louisiana voters tied oil and gas wells' property taxes to production.

Trump Withdraws U.S. from Paris Agreement; Future Involvement Still in Question

President Donald Trump has officially withdrawn the U.S. from the Paris Agreement on climate change, a move Democratic presidential candidate Joe Biden has said he would reverse if he wins the election.

Read the Full ArticleBiden Victory Could Usher in New Era of Environmental Justice Policies

Environmental justice policies could be prioritized like never before if presidential candidate Joe Biden wins the White House next month, which could have widespread ramifications for infrastructure permitting and climate policy.

Read the Full Article

Trade Tensions

Life After the Elections

The results of the U.S. elections on November 3 could radically alter trade policies and their impact on supply chains no matter who wins, with both the up- and down-ticket races making a difference.

The closest area of similarity between President Trump and former Vice President Biden is in the two candidates’ focus on employment and geopolitics as drivers of trade policy. Both Biden and Trump have clearly stated tough-on-China stances.

While much of the focus has been on the Executive, the makeup of the House and Senate will also have a critical impact on the direction of trade policy. A divided House and Senate has not prevented the Trump administration from enacting most of its trade policies, using a mix of executive action as well as limited large scale trade deals (USMCA, KORUS) with careful negotiations and mini-deals that skirt the need for Congressional approval.

U.S.-EU Trade Deal Seen Remote Even if Biden Occupies White House in 2021

A new president may not mean a new day in trade relations between the U.S. and its largest trading partner, the EU. Democratic presidential nominee Joe Biden has expressed a desire to work with allies to repair rifts widened under the protectionist trade policy of the Trump administration. Smoothing fractured relations with the EU, a bloc Washington did $851.9 billion in goods trade with in 2019, would likely be a central pillar of this effort under a Biden presidency.

Read the Full ArticleChina Slows U.S. Agriculture Purchases Ahead of Election: Analysts

China has slowed down its buying of U.S. agriculture products in recent weeks and remains in a wait-and-see mode ahead of the outcome of the U.S. presidential election, but the country's grain buying is expected to continue in the long run as it looks to diversify its sources.

Read the Full ArticleEurope, Middle East Steel Sector 'Pricing' in Biden U.S. Election Win: Sources

European and the Middle East steel markets are increasingly pricing in a Democratic win in the Nov. 3 US presidential elections, according to regional trading sources consulted by S&P Global Platts Nov. 2.

Read the Full Article