Credit

Global Credit Outlook 2021: Back On Track?

As we approach the end of this extraordinarily and uniquely difficult year and look ahead, the question foremost in our minds is: Will 2021 be the year we bring the pandemic under control so that the world can get back on track?

The COVID-19 pandemic will continue to dominate the credit story in 2021 but promising news on several vaccines has brought hope that an end is in sight. Yet obstacles to production, distribution, and acceptance mean that the end-date for the pandemic remains uncertain. Even if a vaccine is widely available by mid-year, which is assumed in S&P Global Ratings’ baseline, the containment of the pandemic is likely to be very uneven worldwide. Until then, the main risk for the first half of 2021 is that further waves of COVID-19, requiring renewed containment measures, may harm a fragile economic recovery and lead to further credit deterioration, particularly in sectors most exposed to social distancing and travel restrictions.

Once the pandemic is largely contained, the focus will likely turn to the gradual phasing out of extraordinary stimulus measures—and the social, economic, and credit implications of doing so.

Latin American 2021 Corporate Credit Outlook: A Year Of Varying Recovery

Economies in Latin America are picking up steam, but they remain vulnerable to setbacks due to the fragility of the recovery and the fact that governments don’t have much room for additional fiscal stimulus if a second wave occurs.

Read the Full ArticleDefault, Transition, and Recovery: The Elevated Weakest Links Tally May Signal Sustained Default Pressure in 2021

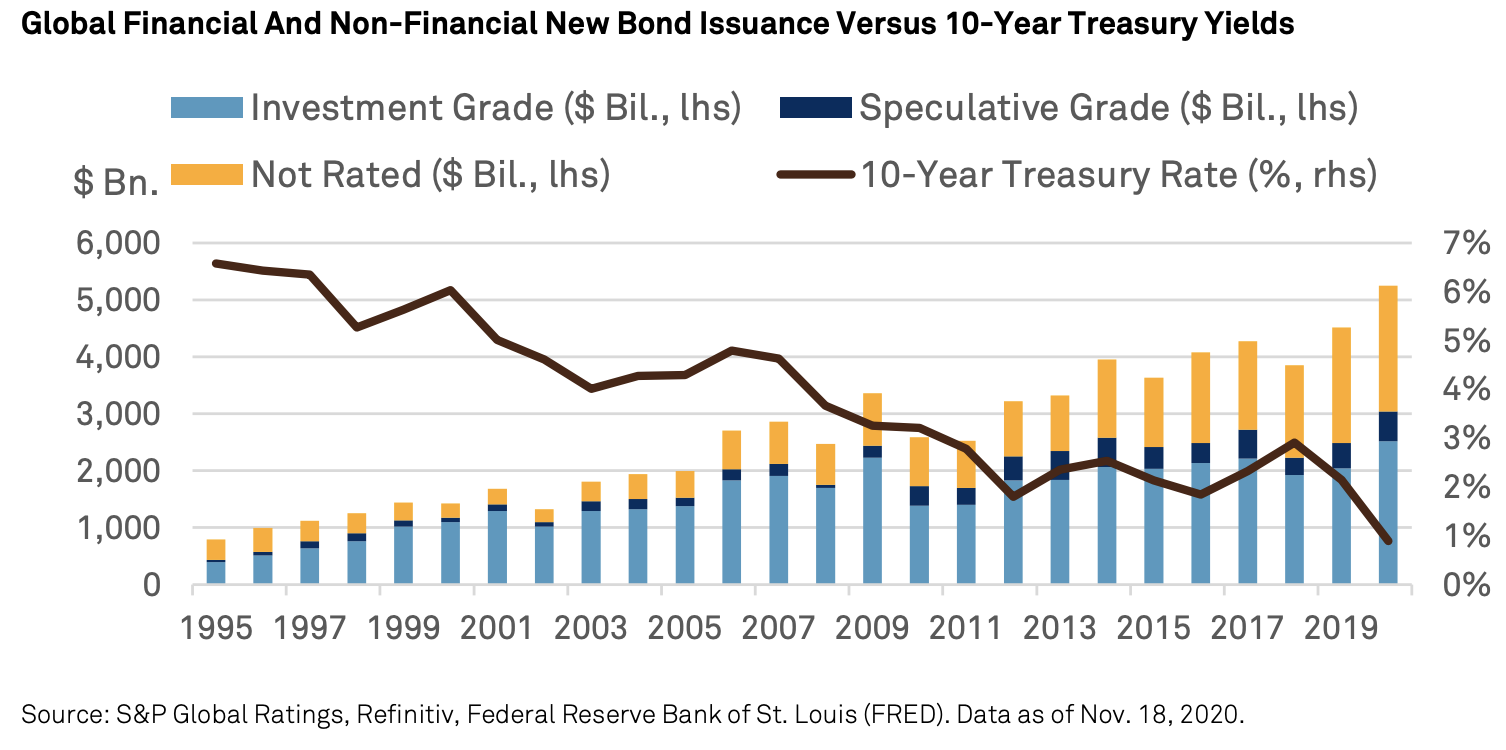

The number of weakest links (issuers rated 'B-' or lower by S&P Global Ratings with negative outlooks or ratings on CreditWatch with negative implications) decreased in the second half of 2020 as financing conditions continued to improve, even for the lowest-rated issuers, but were still elevated by historical standards.

Read the Full ReportGlobal Structured Finance 2021 Outlook: Market Resilience Could Bring Over $1 Trillion in New Issuance

Entering 2021, the impact of the COVID-19 pandemic on global macroeconomic growth and the knock-on effects on asset prices, market sentiment, interest rates, and consumer credit (to name a few) will remain the key factors dictating structured finance issuance and performance through the year.

Read the Full Report

Economic Recovery

Emerging Markets Monthly Highlights: A Brighter 2021, From Afar

Recovery prospects look brighter for 2021, but the sequence of the recovery matters. The recent endorsement of the COVID-19 vaccine in the U.S. and other countries supports a potentially faster economic recovery in 2021.

However, the vaccine still needs to be effectively distributed and immunization needs to take place before the pandemic fades. Consequently, the short-term outlook still looks challenging, especially for those EM economies where cases are surging again.

The recent slowdown in economic activity will probably extend into the first quarter of 2021. This sequence is especially stressful for those governments facing the rising debt and fiscal pressures and for corporations with depressed revenues and limited room to further cut expenses.

Local And Regional Governments Outlook 2021: Gradual Recovery Will Test Rating Resilience

The consequences of the COVID-19 pandemic will weigh on the credit quality of non-U.S. local and regional governments in 2021.

Read the Full ArticleLarge Capital Goods Companies Are Positioning Themselves For A Post-Pandemic Recovery

Though S&P Global Ratings expects conditions to remain on an upswing in the coming year, there's still significant risk as the pandemic continues to be the dominant force shaping the sector and overall economic development.

Read the Full Article

U.S.

U.S. Public Finance 2020 Year in Review: One Like No Other

As the pandemic has continued to spread this year, public finance issuers across the U.S. have had to navigate the social, financial, and economic effects of the disease. The pandemic and its aftermath will continue to dominate credit conditions in 2021.

Despite a vaccine in sight, the virus curve is spiking and there is likely to be additional economic damage ahead in the U.S. S&P Global Ratings expects the aftershocks from 2020 will be reverberate for many years in U.S. public finance and will continue to be felt unevenly by sector and state.

S&P Global Economics expects real GDP to contract 3.9% this year and not get back to precrisis levels until the third quarter of 2021 The U.S. unemployment rate won't reach its precrisis low until after 2023.

2021 U.S. Telecom And Cable Outlook: Rising Leverage Overshadows Economic Resilience

Despite the COVID-19 pandemic and recession, financial results for the U.S. telecom and cable industry held up well in 2020 because of the utility-like nature of their products and services.

Read the Full ReportOutlook For U.S. Water And Sewer Utilities: 2021 Provides 2020 Hindsight

The negative pressures from COVID-19 may take longer to present themselves, if they materialize at all.

Read the Full ReportSolid Capital Levels Position U.S. Life Insurers to Withstand a Tough 2021

Overall, S&P Global Ratings thinks this might be a tough year for the life insurance companies S&P Global Ratings rate, but S&P Global Ratings expects insurance companies will be able to navigate through the difficulties without a significant negative impact on their credit quality.

Read the Full ReportU.S. Health Insurers' Credit Quality Will Likely Hold Up In 2021

S&P Global Ratings expects U.S. health insurers' credit quality to hold up in 2021 despite the COVID-19 pandemic and economic weakness.

Read the Full ReportAfter Ending 2020 Strongly, U.S. Auto Sales are Set to Continue Recovery in 2021

S&P Global Ratings expects U.S. light-vehicle sales to rise by 10%-15% year over year to over 16 million in 2021 before stabilizing to 16.5 million in 2022.

Read the Full Report

Market Volatility

Copper Price to Rise in 2021: Analysts

A rise in the price of copper is likely to continue in 2021 on low inventories and a bullish demand narrative, though at a slower pace, industry analysts said.

The red metal has found support on the back of upcoming elections and labor negotiations in Chile and Peru, an anticipated rebound of the global economy, sustained growth of industrial activity as well as robust metal demand by China, global COVID-19 vaccination rollout, and a weaker dollar.

"This provides a lot of confidence," said ABN AMRO Group senior economist Industrial Metals Markets Casper Burgering.

"As a result, total long positions are high, but this also brings a downside price risk because it increases the likelihood of profit-taking by speculators. In 2020, the market has taken a substantial advance on the good news of 2021. The copper price will rise further in 2021, but in a lower gear."

Gold's Big Year Slows Near End, but Market Observers Optimistic for 2021

Gold markets have had an exciting 2020 to date, but positive news regarding COVID-19 vaccines rolling out and the quelling of anxiety around U.S. election outcomes has dampened some of the enthusiasm for the yellow metal, market observers said during a virtual event hosted by State Street Global Advisors and the World Gold Council.

Read the Full ArticleOil Prices Could See Choppy Recovery Through 2021 as World Wrestles Pandemic

After crumbling to historic lows in early 2020, crude oil prices should continue to recover at a choppy pace, returning to pre-pandemic levels by the end of 2021, analysts said.

Read the Full Article

Banking

U.S. Bank Outlook 2021: Picking Up The Pieces And Moving On

Bank earnings will improve on lower credit loss provisions, although pandemic-related asset quality challenges and decades-low net interest margins will keep profitability ratios below 2019 levels. The recently passed $900 billion stimulus bill, continued economic growth, and vaccine distribution will keep credit losses from rising as high as S&P Global Ratings had anticipated earlier in the pandemic.

Loan charge-offs triggered by the pandemic will move toward S&P Global Ratings' updated estimate for the U.S. banking system of 2.2% rather than S&P Global Ratings' prior 3% estimate. With provisions, which equated to about 1.2% of loans in the first three quarters of 2020, falling to 1% or less of loans in 2021, allowances for credit losses will shrink.

The Biden Administration and a Democrat-controlled Congress could push for more stimulus--which may benefit the economy and bank asset quality--but also higher corporate taxes and tougher regulatory and legal enforcement, which could pose risks for banks. Capital and liquidity will remain in good shape. However, regulatory capital ratios, which rose in 2020 in part due to restrictions on shareholder payouts, will likely decline with the easing of those restrictions.

Global Banks 2021 Outlook: Banks Will Face The Next Test Once Support Wanes

The sharp rebound in global growth that S&P Global Ratings expects in 2021, together with strong bank balance sheets, support from authorities to retail and corporate markets, and regulators' flexibility, should limit bank downgrades in 2021.

Read the Full ReportMarket Recovery to Underpin Rise in Sukuk Issuance in 2021

The global volume of Islamic bond, or sukuk, issuances is projected to rise in 2021 following an expected market and economic recovery in core Islamic finance countries, according to S&P Global Ratings.

Read the Full ArticleGlobal Investment Banks' Revenue to Remain Elevated in 2021 but Below 2020 Highs

The world's largest investment banks are on track to book record trading revenue in 2020 as COVID-19 triggered capital market volatility not experienced in more than a decade, but analysts expect growth to taper off in 2021.

Read the Full Article

ESG

Recycled Plastics Recover from Pandemic but Economics Remain Challenging

After a tumultuous 2020 for the global recycled plastics markets that saw production margins pressured and bearish virgin prices causing buyers to shun recycled plastics, the first half of 2021 may see a step change, at least in Europe and the US, in reaction to newly signed legislation that may provide an impetus to increased demand.

In the Asian markets, a combination of uneconomic export opportunities and expected low virgin prices well into H1 2021 will likely mean recycled plastics markets will continue to struggle, though upcoming high-specification recycling plants, delayed from 2020, may provide a lifeline and a new impetus to high-specification recycled plastics in the region.

States Racing to Set Goals Toward Net-Zero Emissions, 100% Renewable Electricity

Four more governors announced plans to put their states on a path toward 100% renewables or carbon-free emissions, bringing the total up to 12 states that are leading the US energy transition, while the recent stimulus package could be a major driver for renewable energy penetration.

Read the Full ArticleCommodities 2021: U.S. Renewable Generation Growth Sees New Leaders Rising to the Occasion

Renewable generation across the U.S. has been steadily rising over the years and shows no signs of slowing in 2021.

Read the Full ArticleSocial Bond Market, Healing COVID-19 Divisions, Set to Continue Growing

The COVID-19 pandemic has served as a catalyst for social bond issuance in 2020, as a way for investors and governments to address social divisions laid bare by the health crisis.

Read the Full ArticleCommodities

Global Gas Demand to Rise by 2.8% in 2021, Offsetting 2020 Decline: IEA

Global gas demand is expected to increase by 2.8% -- or around 110 Bcm -- this year, just above the extent of the decline witnessed last year and signaling a return to 2019 consumption levels, the International Energy Agency said Jan. 26.

In its first ever quarterly gas report, the IEA warned, however, that the rate of demand growth remained uncertain due to ongoing concerns over the coronavirus pandemic.

According to the IEA, gas demand in 2020 fell by 2.5%, or by an estimated 100 Bcm -- the largest ever recorded drop in gas consumption.

Demand this year is seen at 4.021 Tcm, up from 3.91 Tcm in 2020.

"Global gas demand is expected to recover in 2021 from an unprecedented drop in 2020," the IEA said.

"Yet the prospect of a prolonged economic impact related to the COVID-19 pandemic heightens uncertainty about the pace and trajectory of growth," it said.

Five Commodity Themes for 2021

After a turbulent 2020 for all commodities, what can we expect in the coming year? S&P Global Platts president Martin Fraenkel shares his view.

Read the Full ArticleSaudi Aramco Faces Tough 2021 as Rivals Race for Oil Capacity

Saudi Aramco may be forced to play catch-up in 2021 as rival state-controlled oil companies closely aligned to OPEC policy in the Middle East race to add new production capacity and win back market share despite deep pandemic-induced output cuts.

Read the Full Article