Around the Tracks

World’s Auto Markets Sink in H1

Carmakers across the globe saw initial signs of improvement in the second quarter, but the auto industry remains concerned about the prospects for a long term recovery as COVID-19 cases have continued to flare up.

As a result, several countries could find themselves implementing another lockdown, which would delay any economic recovery and undermine consumer confidence. Buying cars will be the last thing on the minds of many consumers affected by the pandemic-induced downturn.

Tesla's Market Cap Eclipses Largest U.S. Energy Companies, Global Automakers

The soaring share price for Tesla Inc., already the world's most valuable automaker, has pushed the electric-car maker's market capitalization above the combined value of the six largest U.S. energy companies.

Read the Full ArticleCarmakers' Q2 Losses Slimmer than Feared but Cost-Cutting Pressures Intensify

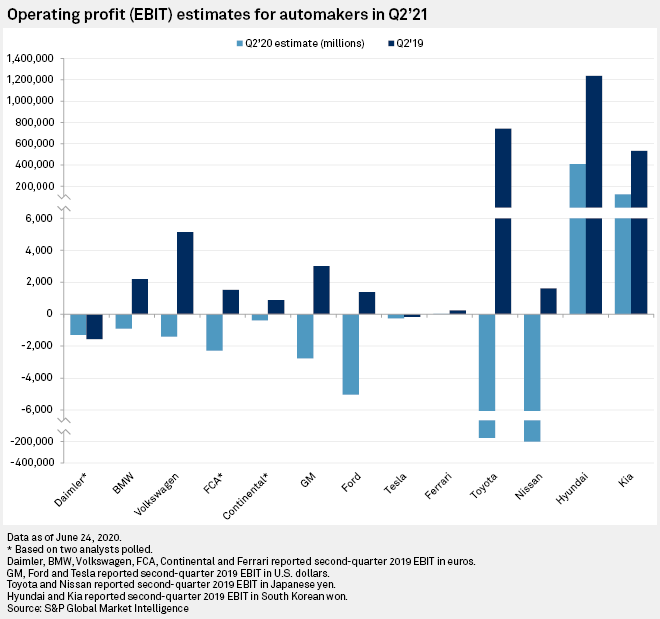

Carmakers' losses were less severe in the second quarter than analysts had feared, but the impact of the coronavirus pandemic has weakened smaller manufacturers' ability to keep up with their larger rivals' defensive pursuit of scale and efficiency.

Read the Full ArticleRegistration is now live for S&P Global Ratings' Auto Industry Hot Topics Virtual Conference. This year's event will take place on Wednesday, October 14 in a virtual format.

Register for the eventCredit

How U.S. Transportation Credit Quality is Affected by COVID-19

The COVID-19 pandemic has been a disruptive force that has dramatically changed the US transportation industry.

In four months, the precipitous decline in public transit ridership, air traffic, parking, toll road transactions, port container volumes, and overall mobility--up to 95% in some subsectors--has contributed to the current recession and the sharpest contraction in economic activity since World War II.

Most Private Auto Insurers Hold off on Additional Premium Credits for now

Emerging trends in claims frequency and driving patterns are giving a number of private auto insurers pause before they commit to additional policyholder credits.

Subsidiaries of at least 13 of Michigan's 15 largest private-passenger auto insurers at the group level exercised their option under a July 8 Department of Insurance and Financial Services order to submit actuarial justification as to why they believe additional refunds are not currently warranted.

Read the Full Article

Global Market

Automotive Tire Demand to Fall 15%-20% in 2020: Michelin

French tire manufacturer Michelin announced its half-year results July 27, and said it expects automotive and light truck tire demand to decline 15%-20% in 2020 as coronavirus looks set to continue to weigh on the global economy.

The company said in its earnings release that tire demand was "vulnerable to a high risk of a major recession" with the original equipment business set to experience bigger declines than replacement.

Volvo Drives on as U.S. Car, Light Truck Sales Suffer COVID-19 Hangover

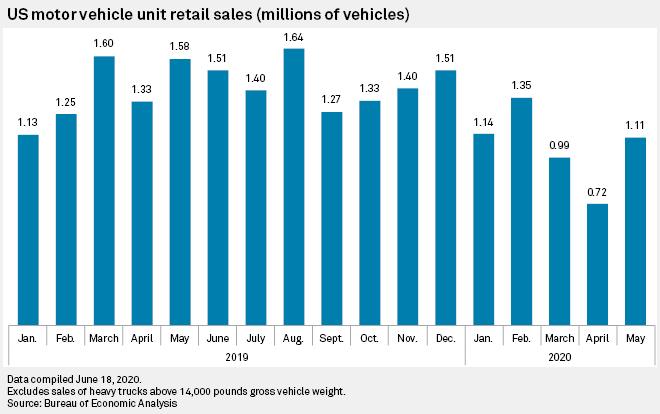

U.S. sales of cars and light trucks appear to still be suffering the aftereffects of COVID-19.

Panjiva's analysis of official data shows that total sales of cars and light trucks produced in the U.S. and overseas fell by 23.3% year over year in June.

Read the Full Article

Electric Vehicles

UK Businesses Urge Government to Target 100% Electric Car, Van Sales by 2030

UK businesses belonging to the UK Electric Fleets Coalition, have called on the government to target 100% electric car and van sales by 2030 as the next step in the UK's green recovery.

The coalition said July 15 it was recommending a comprehensive package of measures to boost the electric vehicle business case, stimulate EV manufacturing and strengthen the charging network.

VW Preparing For Mass-Scale EV Manufacturing: Roskill

VW to invets €1 billion in increasing JAC Volkswagen share from 50% to 75%.

Another €1.1 billion to be spent on 26% share in battery maker Guoxuan High-Tech Co.

Roskill says move shows VW's intention to grow EV presence inorganically in the highly competitive Chinese market.

Read the Full Article

Auto Loans

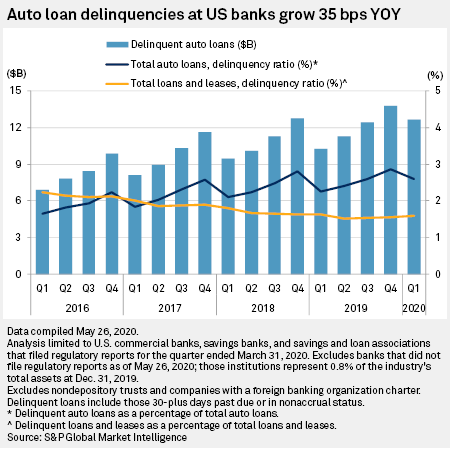

Auto Loans Holding Strong in Uncertain Year of Forbearance

Auto loan delinquencies ticked up in the first quarter year over year and used car values plummeted in April before bouncing back in May. Whether charge-offs materialize will depend on the spread of COVID-19 and the ability of consumers to successfully navigate widespread forbearance programs.

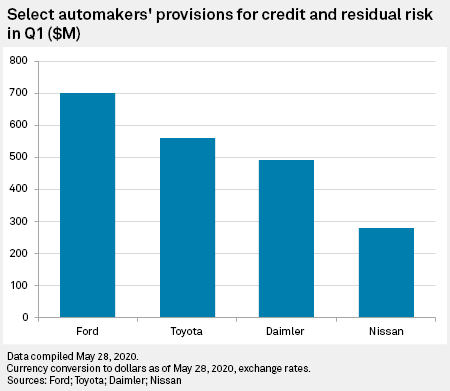

Global Automakers' Finance Arms Brace for Impact from Coronavirus Crisis

In an earnings season not short of dire warnings across every sector about the escalating impact of the coronavirus pandemic, global automakers had their fair share of doom and gloom to offer.

Nissan is reportedly planning to lay off 20,000 employees in Europe and some emerging markets.

Read the Full Article

Related Sector Impact

Subdued Automotive Demand Keeps Petrochemical Market Under Pressure

Petrochemical markets have been significantly affected by the challenges faced by the European automotive industry during the coronavirus pandemic.

Despite automotive plants resuming production and a steady increase in the number of car journeys, the recovery was expected to be slow.

The European Automobile Manufacturers Association (ACEA) has revised its 2020 forecast for passenger car registrations down to a fall of about 25%.

Of Cars and Cans: U.S. Aluminum and the Pandemic

The coronavirus pandemic has obliterated global metals demand as one of the main end uses, automotive applications, has seen major disruptions to the supply chain.

Read the Full Article

New Strategy

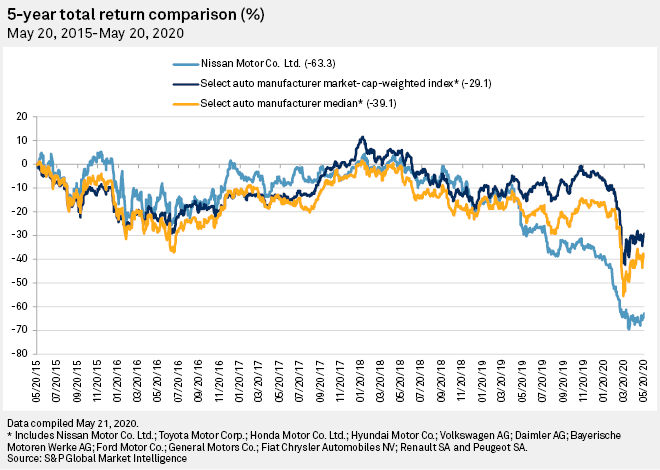

Nissan Seeks To Arrest Decline With New Midterm Strategy

Nissan Motor Co. Ltd. on May 28 will announce a new medium-term strategy with which it aims to turn the page on a period marred by declining performance, management instability and corporate governance shortcomings.

U.S. Automakers Accelerate Online Selling Options During COVID-19 Pandemic

Major U.S. automakers are expanding online sales options during the coronavirus pandemic, a trend that experts say is likely to accelerate even as the largest companies remain reliant on dealerships.

Automakers began expanding their online presence to encourage vehicle sales as government orders that closed businesses, including dealerships, and kept consumers at home caused a drop in demand for new vehicles in the first quarter of 2020 and prompted experts to shave their full-year sales forecasts.

Read the Full Article

China

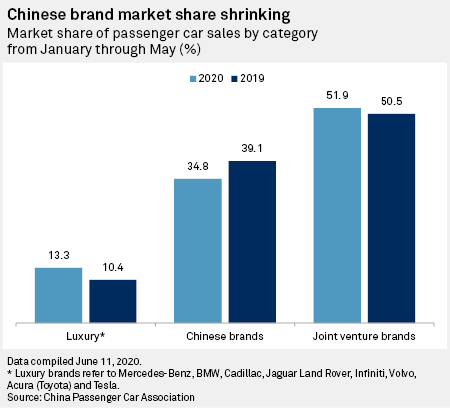

China's Auto Sales Rebound may be Short-Lived

Despite encouraging signs in recent months, China's automotive industry remains set for its third consecutive year of decline in 2020 as the boost from pent-up demand and generous incentives will likely lose steam in the second half, industry observers warned.

The coronavirus pandemic prompted a 42.4% year-over-year sales slump from January through March as dealerships were shuttered and citizens remained under lockdown. Still, demand has returned since with sales rising 4.4% year over year in April and 14.5% in May, according to data from the China Association of Automobile Manufacturers, or CAAM.

Carmakers are a Step Behind in Industrial China's COVID Comeback

China's industrial sectors are staging a strong recovery from the COVID-19 outbreak, with production and public demand picking up sharply from their March lows.

In 2020, government policies and infrastructure-focused stimulus will likely drive growth for many industries, including engineering and construction (E&C) and capital goods makers. S&P Global Ratings expects ratings in these sectors to be generally stable in COVID's aftermath, with most fundamentals in good shape. Carmakers are a weak spot, given the softness of consumer confidence.

While China's auto sales significantly beat our expectations in the second quarter, the sustainability of this recovery is uncertain.

Read the Full Article

Auto Sales

Tight U.S. Auto Inventory Likely to hit Already Depressed Car Sales, Experts Say

Consumers are facing a limited selection of new cars and trucks at U.S. dealerships and might delay plans to buy a new ride, experts say, because of tighter inventory levels from battered supply chains and auto production shutdowns caused by the coronavirus pandemic.

Car sales, which suffered heavily throughout the pandemic, have started to show some signs of improvement. Automakers like General Motors Co., Ford Motor Co. and Fiat Chrysler Automobiles NV have added shifts to their assembly plants and worked through traditional summer downtime, but growth in supply has yet to catch up to demand, according to experts. Auto industry tracker Wards Intelligence expects inventory levels will not start making significant gains until the end of the summer. The firm predicts inventories could still be about 30% lower than year-ago levels at the end of July.

Canadian Auto Sales Maintain Month-on-Month Rise in July

Pittsburgh — Canadian new light vehicle sales in July inched up 6.2% from June to 165,020 units following month-on-month increases of 147% and 37.3% in May and June, respectively, signaling steady recovery in the country's automotive market, DesRosiers Automotive Consultants said Aug. 5.

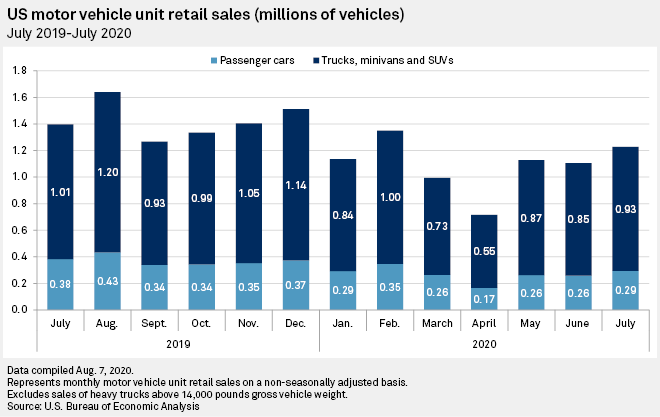

Read the Full ArticleU.S. Auto Sales Drop by a Third in Q2 Over Coronavirus Impact

U.S. auto sales declined 33.3% in the second quarter of 2020 from a year earlier due to the coronavirus pandemic that forced consumers to stay at home.

An S&P Global Market Intelligence analysis found that overall nonseasonally adjusted U.S. vehicle sales for the period totaled 2.95 million units, down from the 2019 figure of 4.42 million units.

Read the Full Article

Survival Mode

Automakers Limp out of Worst Quarter in Living Memory

Almost all global automakers are preparing to report significant losses for a calamitous second quarter, analysts estimate, switching industry watchers' focus from profit to cash flow management and survival.

UK Car Industry Calls for Support Package, Warns on Risks of No-Deal Brexit

The UK auto industry has called for a dedicated restart package to help protect jobs, citing a survey showing that up to one in six jobs in the sector are at risk of redundancy.

SMMT carried out a member survey this month which garnered 290 responses delivering 239 individual company responses, representing a combined GBP77 billion ($96 billion) turnover and 148,917 permanent employees.

Structured Finance Credit Brief

Though Still Elevated, Drops in May Extensions are the First Signs of a Possible Road to U.S. Auto Loan ABS COVID-19 Recovery

New extensions in May dropped significantly from April. Even so, at May end, several issuers have 10% or more of their pools (on a dollar basis) in some form of extension status.

U.S. Auto Loan Extension Congestion Partially Clears up in May

U.S. auto loan extensions have generally decreased in May. Seven of the 21 Reg AB II shelves in our analysis have now uploaded their loan-level data files, and they are showing significantly lower extensions in May than in April.

Both Santander's DRIVE and SDART platforms--two of the four Reg AB II subprime shelves--reported reductions in extensions of 42% and 45% by balance (43% and 46% by loan count), respectively, for May versus April.

Read the Full Report