Subscribe to start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

SUBSCRIBE TO THE NEWSLETTERFuel's Future

Malaysia Ranks Among China's Top Gasoline Importers in June

China's gasoline exports to Malaysia recovered to 204,200 mt in June from just 8,500 mt in May, making it the second biggest recipient of Chinese outflows in the month, showed detailed data released July 21 by the General Administration of Customs.

The June gasoline exports were largely steady compared with the average volume of around 192,700 mt shipped to Malaysia in the past 10 months of July 2020-April 2021, the data showed.

During the first half of 2021, total gasoline exports to Malaysia were at 1.12 million mt, up 74.9% on the year. Further, China imported about 36,000 mt of gasoline from Malaysia via companies registered in Hainan province, in addition to 24,700 mt from Singapore, the data showed.

CNOOC imported 50,000 mt of gasoline resulting in a profit of Yuan 15 million/mt ($5.46 million/b). Of the 50,000 mt imported, the first 25,000 mt was injected into oil tanks in Nantong in east China. Trading company Sinochem also imported several cargoes to benefit from good margins in the domestic market, S&P Global Platts reported earlier.

In addition, China exported rare cargoes totaling 50,000 mt to Saudi Arabia in June, after such shipments were last made in September 2019 at 56,000 mt. The latest exports came at a time when Saudi Arabia's 400,000 b/d Jazan refinery has become fully operational, largely reducing its dependence on imported gasoline barrels for the next six months.

In H1, Southeast Asia remained the top destination for China's gasoline outflows, with the region accounting for about 90% of the total. Australia has also increased its imports from China by 160.8% on the year at 213,000 mt.

Independent Plants in China Turn to Fuel Oil Instead of Bitumen Blend

China's independent refineries received their first fuel oil cargoes after the new consumption tax on bitumen blend took effect on June 12.

Read the Full ArticleChina 'Needs a Future Coal Industry, Not a Future Without Coal'

China's strategy to achieve net zero will require large-scale deployment of carbon capture, usage and storage (CCUS) to remove CO2 from coal-fired power generation and from hydrogen production, energy experts said at June 22 forum.

Read the Full ArticleAsian Coal, LNG Prices Surge as China's Economic Engine Powers Up

Seaborne thermal coal prices have hit multi-year highs, and spot Asian LNG prices for summer have not been this strong since summer 2018, on the back of power and feedstock demand as economic activity in China rivals the post-pandemic resurgence in the US.

Read the Full Article

Emissions

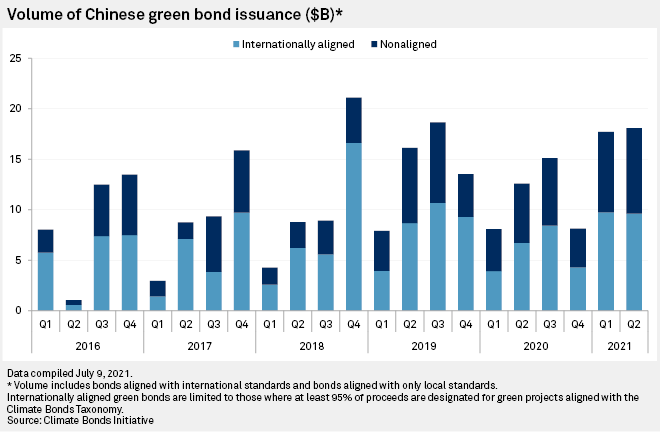

China's Push for Emissions Reduction to Boost Green Bond Sales

China's green bond issuance in the April-to-June period rose to its highest point in almost two years as the world's biggest polluter pushes ahead with plans to cut emissions, with the goal to become carbon neutral by 2060.

China Prepares Groundwork to Include Refining, Petrochemical Sector in Emissions Trading Scheme

Beijing is preparing the groundwork for including the refining and petrochemical sector in China's national emissions trading scheme, or ETS, as part of efforts to meet its target of net-zero emissions in 2060.

Read the Full ArticleChina's Big 5 Power Producers Face Uphill Battle in Meeting Peak Emissions Targets

China's five largest independent power producers, or IPPs, who account for around 44% of the country's power generation capacity, have set ambitious targets to peak carbon emissions by 2025 or earlier, but face several obstacles in reaching this lofty goal.

Read the Full ArticleCarbon

China Launches National Carbon Market; First CO2 Trades at $8.20/mt

China's national carbon market started trading on July 16 with the first CO2 trade done at Yuan 52.80/mt ($8.20/mt), a relatively low carbon price compared with regulated markets in the US and Europe.

China's Initial Carbon Prices to Balance Growth Needs with Long-Term Climate Goals

China's carbon market that starts trading in June is more likely to resemble a marathon with long-term goals rather than a 100-meter dash focused on immediate heavy-handed regulations to curb emissions, according to experts who have helped designed the system.

Read the Full ArticleChina’s Carbon Emission Trading Scheme Set to Kick-Off

On this week's Platts Market Movers Asia with Senior Analyst Oceana Zhou: China's national carbon emission trading scheme is set to become operational at the end of June. The scheme will give rise to the world's biggest carbon market, with nearly 4 billion tons of carbon allowances.

Read the Full ArticleThe COVID-19 pandemic has altered the global energy sector’s shift from fossil-based systems of energy production and consumption—including oil, natural gas, and coal—to renewable energy sources like wind and solar, as well as lithium-ion batteries.

ACCESS THE TOPIC PAGECommodities

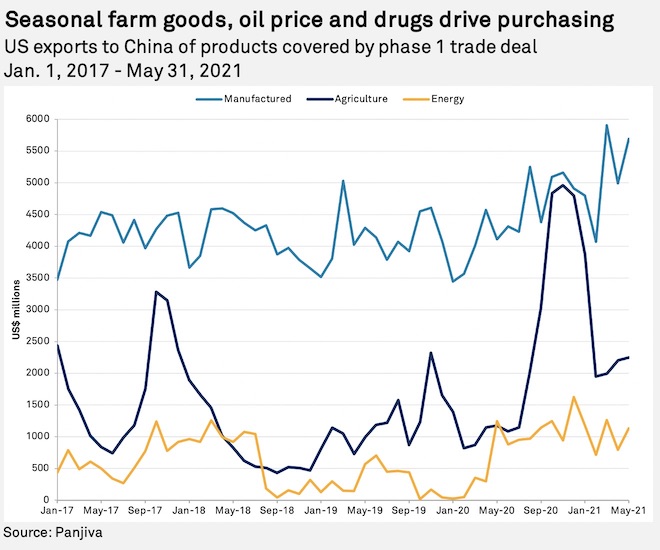

China Imports More U.S. LNG but Still Poised to Miss 2020 Trade Pact Goals

Chinese imports of U.S. LNG have surged in recent months, helping to keep U.S. export facilities running close to full bore. But the purchases are short of the levels called for under the truce that ended a year-long freeze in the LNG trade between the two countries.

China's Commodities Demand Growth to Slow; Energy Transition to Uphold Prices

A slowdown in Chinese growth rates is likely to make the Asian giant's economy less commodities-intensive in future, putting a brake on spiraling prices and on any current "supercycle," according to participants at the Financial Times' Commodities Global Summit June 15.

Read the Full ArticleCrude Oil Futures Tick Lower Amid Softening Chinese Demand Cues

Crude oil futures dipped during mid-morning Asian trade June 8, amid softening demand cues from independent Chinese refineries, even as strong demand indicators from the West and slow progress in US-Iran nuclear talks, which could lift sanctions on Iranian crude, continue to support sentiment.

Read the Full Article

Metals

China's Aluminum Prices Under Pressure as NDRC Issues Statement on Stock Release

China will continue to release metals stocks from its reserves in batches in the upcoming months in a bid to alleviate pressure on downstream processors and fabricators, the National Development and Reform Commission said in a press conference July 19.

China's domestic aluminum prices have been on the rise in recent weeks, as major smelters curbed output in the face of power supply shortages, propping up material prices that posed challenges to end-users.

Metal, Steel Production Must Relocate Near Renewable Energy to Decarbonize

Steel and metals will need in future to be produced near sources of renewable, cheap power if decarbonization goals are to be met, a leading metals markets analyst told the Qatar Economic Forum on June 22.

Read the Full ArticleChinese Steel, Metals Price Rise Curbs 'Short Term Game' with Limited Impact

China's current move to curb metals speculation and rising prices is a "short term game" that would not materially impact price levels, Ivan Glasenberg, CEO of metals producer and trader Glencore said June 22. Prices will stay strong on underlying demand and supply fundamentals, he said.

Read the Full Article

Policy

China Reaches A Milestone for Power Reform with Higher Peak Retail Tariffs

S&P Global Ratings said today that China has reached another milestone for its market-oriented reforms. The National Development and Reform Commission (NDRC) has set higher peak retail tariffs, allowing more effective cost passthrough for the electricity sector.

Key Takeaways

-

Indirectly, the higher tariffs will support the industry at a time of increasing leverage. The industry will incur aggressive capital expenditure to meet the country's "dual-carbon" targets under its 14th five-year plan (2021-2025).

-

On July 29, 2021, NDRC announced approval for retail electricity tariffs to rise by at least 20% during hours of peak demand.

-

According to the NDRC's notice, the peak tariffs should be no less than 3x of valley tariffs; and no less than 4x if the peak-valley demand gap exceeds 40%. Peak-valley tariffs should reflect local peak-valley demand patterns, share of renewables, and peak-shaving capability.

-

In July 2021, China Electricity Council (CEC) revised up its forecast for power demand to grow 10%-11% this year; its second revision since February.