Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Global Trade Remains Immense But Is Changing

Many people try to tell a tidy story about global trade. But economic stories are rarely simple, and change is the only constant when it comes to global trade. Imports and exports change year to year for every country. Speaking at the World Economic Forum Annual Meeting in Davos, Switzerland, S&P Global CEO Douglas Peterson reviewed the state of global trade for attendees. The following is a summary of Peterson’s remarks.

You may have heard that trade declined by approximately 5% in 2023, but that is after a 12% increase in global trade in 2022. When you look at the data, it becomes clear that the global trade of goods and services remains very robust. Overall global trade stood at roughly $25 trillion in 2023, which is about equal to the US’ GDP of $26.5 trillion. While trade volumes declined in countries such as China, where exports fell 6% last year, others such as Brazil experienced export growth of 4%.

To detect patterns in global trade, it helps to focus on certain sectors and shorter timescales. The global oil market makes up a substantial portion of the approximately $24.9 trillion in international trade. With the Jan. 4 closing price of Platts Dated Brent at $76.015/b, the value of the physical trade in global oil is close to $3 trillion.

According to S&P Global Commodity Insights, global oil demand will reach a record 103.8 million b/d in 2024, up 1.5 million b/d on the previous year. But trade flows for oil markets have substantially shifted in the last five years. The largest trend is the shift of the Middle East oil market toward China as the US becomes a net exporter of oil. According to S&P Global’s ship-tracking data, about 60% of oil exports from the Middle East’s Gulf states are sent to Asia.

Following Russia’s invasion of Ukraine, the Group of Seven worked to establish a price cap on Russian oil. The goal was to maintain global oil supply while limiting the upside for Russian producers. According to S&P Global research, Russian seaborne crude exports have proven quite resilient. However, the trade flows for Russian crude have changed substantially. Until early 2022, Russian crude was primarily purchased by European customers. After the imposition of sanctions, Europe gradually faded as a customer, and China, India and Turkey became the leading export markets.

Moving to related industry, global trade in automobiles has transformed over the last 10 years. The big story in vehicles has been the continuing rise of China. According to S&P Global, China has overtaken Japan as the world’s top car exporter. In 2022, China’s vehicle exports grew 57% year over year to 3.32 million vehicles. China’s growth didn’t come at the expense of other regions, which also reported higher production numbers in 2023 — the country just grabbed a bigger slice of a growing pie.

Another way to look at global trade is to observe capital flows. There have been some shifts in capital flows, reflecting changes in supply chains and trade relationships generally. Over the past five years, the changes between India, which is attracting much more capital, and China, which appears to be attracting less, are notable. For example, the share of global venture capital flowing into India is expected to double by 2030. Foreign direct investment into India has reached record highs in the last four years, peaking at $85 billion in fiscal 2021–2022.

Today is Thursday, January 18, 2024, and here is today's essential intelligence.

Written by Nathan Hunt.

Economy

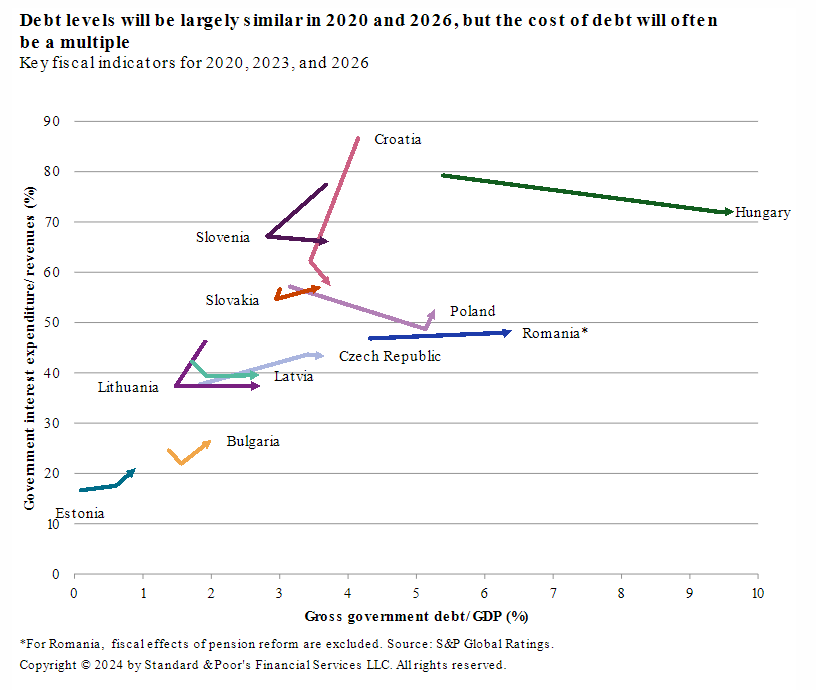

Elections, Defense Spending, And Interest Costs Will Keep CEE Fiscal Deficits High

Central and eastern European (CEE) sovereigns' fiscal deficits will remain among the largest in EMEA in 2024; they are one of the key risks to S&P Global Ratings’ sovereign ratings. After record-high deficits over the past four years, most CEE sovereigns will find it difficult to meaningfully start reducing their debt — some more than others. Key risks to fiscal consolidation over the next two years include the busy election calendar, higher-than-anticipated inflation, high defense spending, weak GDP growth and permanently higher interest costs.

—Read the report from S&P Global Ratings

Access more insights on the global economy >

Capital Markets

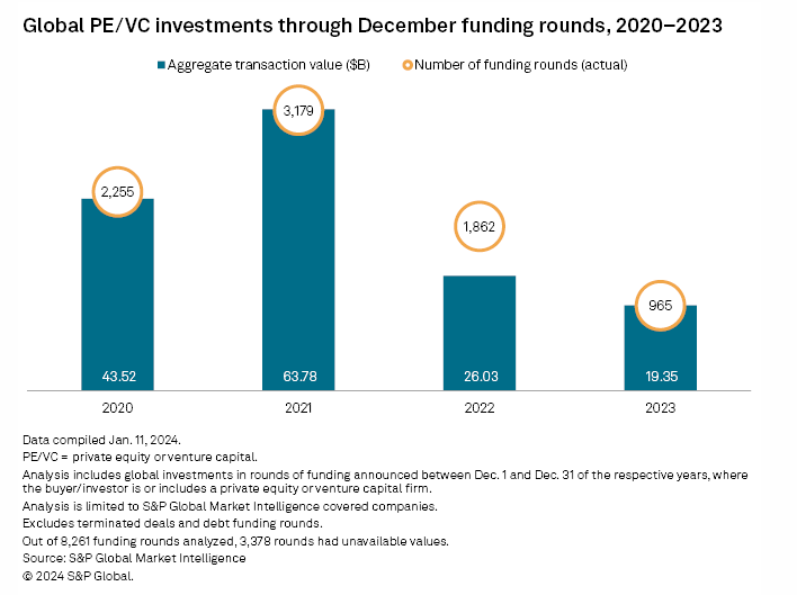

Global Venture Capital Investments Continue Downtrend In December 2023

The value and volume of global venture capital funding rounds continued to fall in December 2023. Transaction value fell 25.7% year over year to $19.35 billion, while deal count was down 48.2% to 965. Both figures were the lowest totals for any December since at least 2020, according to S&P Global Market Intelligence data. The total value of funding rounds in 2023 came in at $260 billion, a 40.3% decrease from the full-year total of $435.72 billion in 2022, data shows. Deal volume amounted to 15,834 in 2023, down 31.9% from 23,251 a year ago.

—Read the article from S&P Global Market Intelligence

Access more insights on capital markets >

Global Trade

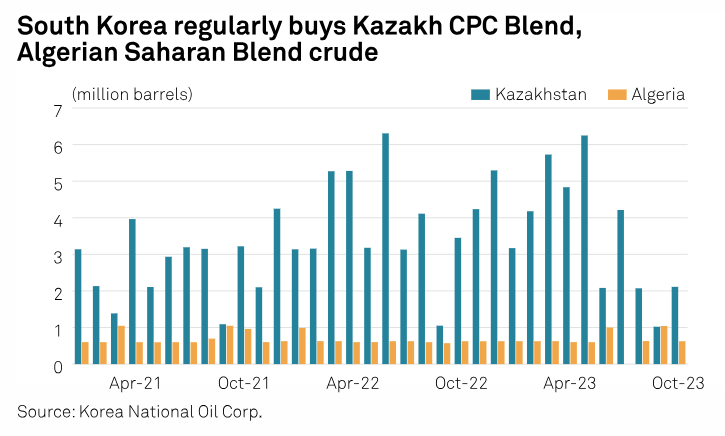

South Korea Sees Limited Risk For Middle East Crude Imports Amid Red Sea Tensions

South Korea's Trade Ministry and major local refiners expect tensions surrounding the Strait of Hormuz and Houthi militant activity to hardly impede the nation's Middle Eastern crude imports, but some CPC Blend crude cargoes may witness delays in arrival as they take the longer Cape of Good Hope route, refinery and government sources said Jan. 14-16. There is no disruption in crude oil shipments from the Middle East so far, the Ministry of Trade, Industry and Energy said in a statement after it held an emergency meeting with major refiners, including SK Innovation and S-Oil on Jan. 14, to check on crude supplies and trade flows from the Persian Gulf market.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

Sustainability

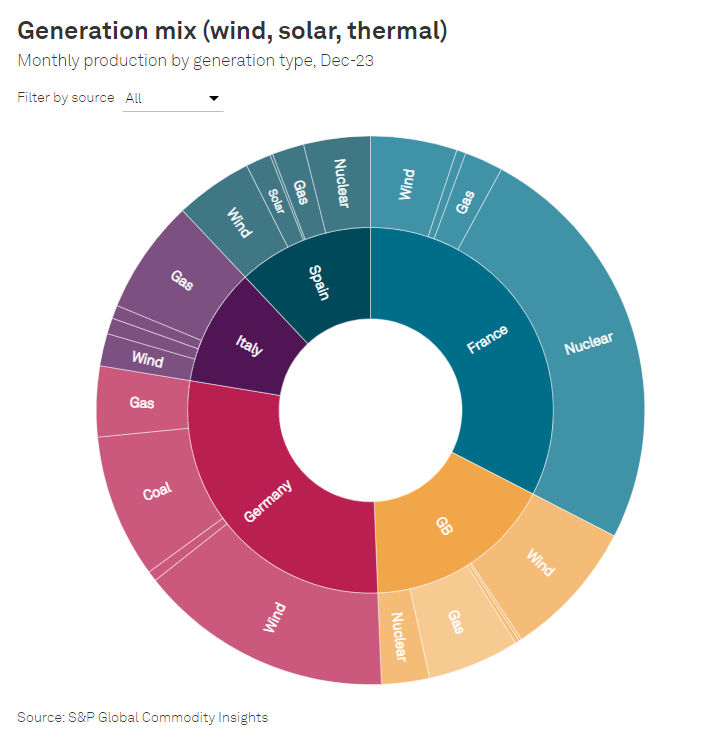

Interactive: Platts Renewable Energy Price Explorer

Market values for wind and solar across Europe fell sharply in December as record wind generation deflated prices, Platts Renewable Energy Price Explorer shows. German onshore wind plunged to the lowest monthly average since May 2021 amid widespread negative hourly prices over the holidays. The Explorer shows the "capture price" renewable energy generators receive based on hourly output and pricing data on a volume-weighted monthly average basis.

—Read the article from S&P Global Commodity Insights

Access more insights on sustainability >

Energy & Commodities

Asia's Petrochemical Outlook 2024 — The Last Cough Of A Cyclical Trough

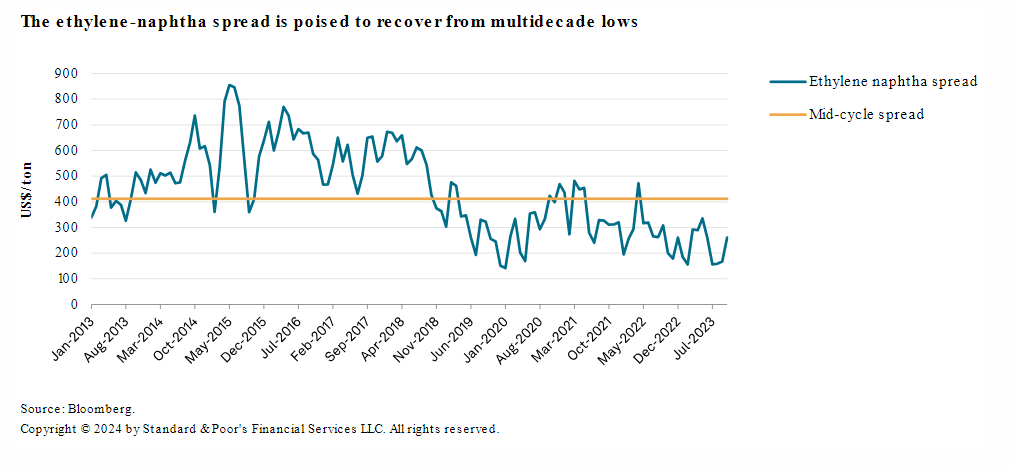

The Asian petrochemical industry is likely heading for a better 2024. High oil prices and weak Chinese orders sent spreads on benchmark products to multidecade lows last year. However, this is a highly cyclical sector, and supply and demand eventually come into balance. S&P Global Ratings expects global utilization rates of ethylene to recover, slowly increasing spreads this year. Moreover, while global firms have flagged heavy capacity expansion, entities typically overstate their intentions. This likely will prove the case in 2024, with producers bringing less new capacity online than previously projected. This reduction may partly help the market recuperate.

—Read the report from S&P Global Ratings

Access more insights on energy and commodities >

Technology & Media

Tech Disruption In Retail Banking: Regulation And Infrastructure Development Can Help Nigeria's Retail Banks Fend Off Fintechs

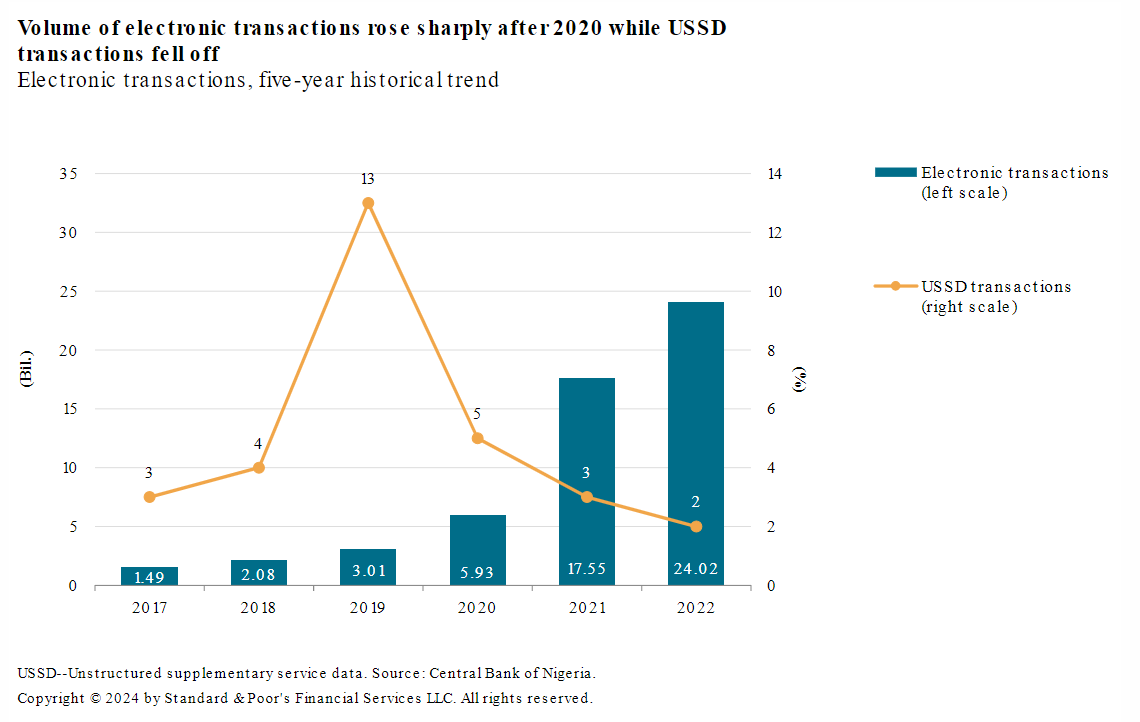

Nigeria is among the most advanced countries in Africa in terms of internet infrastructure, and one of the three main tech hubs on the continent. The Central Bank of Nigeria (CBN) has been an early mover in digitization with its retail Central Bank Digital Currency (CBDC), open banking regime and sandbox environment. Banks have embraced new technologies, created digital platforms to deepen financial inclusion and catered for the unbanked and underserved living in remote areas.

—Read the report from S&P Global Ratings