Discover more about S&P Global’s offerings

Authors: Dr. Beth Ann Bovino, U.S. Chief Economist & Managing Director, and Dr. Rafia Zafar, Independent Researcher

Writer: Joe Maguire, Research Contributor: Molly Mintz, Digital Designers: Victoria Schumacher, Jack Karonika

Executive Sponsors: Alexandra Dimitrijevic and Paul Gruenwald

Published: June 8, 2021

Black women in America face several hurdles to success, particularly regarding educational and professional opportunities, with the white-Black wage gap for female professionals at $12,700 in 2019. These inequities also mean lost productivity and lost economic growth.

If educational attainment among Black women had kept pace with that of white women from 1960-2019, the U.S. would have generated an additional $107 billion in economic activity.

Moreover, if Black women had also been in positions that better matched their education and skill sets, the productivity boost would have added an overall $507 billion to the world’s biggest economy.

If the educational and professional gaps between Black and white women had been closed, a Black college-educated female professional would have made $5,000 more in annual wages in 2019. A still-large ($7,600) gap exists even controlling for the quality of education.

These inequities, exacerbated by COVID-19, leave Black women even further behind economically, with a bigger percent drop in their participation rate and an unemployment rate now almost double that of white women.

A Congressional Budget Office (CBO)-like "score" could assess the impact legislation would have on the economic feasibility and accessibility to the workforce for Black women and women of color.

As the U.S. continues to grapple with the issue of racial inequality, S&P Global analysis shows that disparities in opportunities--specifically for Black women in America--carry a significant cost, not just from a social aspect but also for the economy overall. In simplest terms, the inequalities Black women face have been a drag on both their bank accounts and on long-term economic growth for everyone. These inequities were only exacerbated by COVID-19 and may leave Black women even further behind economically.

Listen to a synopsis of this research, read by one of our lead authors.

In a word, the economic cost of the certain educational and professional gaps is astounding. Given that higher education correlates strongly with higher wages, we found that if educational attainment among Black women had kept pace with that of white women from 1960-2019, the U.S. would have generated an additional $107 billion in economic activity (see the graphic below). Factor in the historic underemployment of Black women, and the results are even more startling. If Black women had not only kept pace in achieving college degrees but had also been in positions that better matched their education and skill sets, the productivity boost that would have resulted means the world’s biggest economy would have generated an additional $507 billion to GDP in that time.

The breakdown regarding personal finances is just as telling. If the educational and professional gaps between Black and white women stayed at rates seen in 1960 (all other factors constant), a Black college-educated female professional would have made $5,000 more in annual wages by 2019. Sadly, however, a still-large wage gap exists even when controlling for education. In our hypothetical scenario, adjusted for the quality of education, a Black professional woman’s annual earnings would still be $7,600 lower than that of a professional white woman.

Clearly, closing these gaps won’t happen in a vacuum--and multiple variables are always at play when it comes to the causes of economic inequity. But this doesn’t diminish the larger truth that structural and systemic racism has long stymied the economic advancement and prosperity of Black communities in America. This perpetuates by putting future generations at an economic disadvantage, most notably with regard to mobility and income, particularly as it relates to education levels. Black women especially have long suffered the disadvantages of misogynoir--the confluence of sexism and racism that results in discrimination against Black women i.

This is reflected in--and, in part, caused by--the widening gap in advanced degrees between Black and white women (see Appendix A). Data from the American Community Survey (ACS) shows the difference between the share of white women who received a college degree to that of Black women widened from around five percentage points in the 1940s and 1950s to an astonishing 13 percentage points by 2019 (see chart 1)ii. In 2019, 49.3% of working white women had a college degree, versus 36% for Black women of working age.

Chart 1: Closing The College Gap For Black Women

In particular, the college gap has widened dramatically since 1980, despite steps in the 1970s to address the inequities all women faced in the jobs market, discussed later in this report. The onset of the Reagan Era appears to mark an inflection point for at least one other indicator, the wage gap, which grew sharply post-1980, according to data from ACS. While our analysis examines prospects for Black women, we recognize that this is also true for other groups.

This matches our earlier analysis of historical U.S. income dynamics (see “How Increasing Income Inequality Is Dampening U.S. Economic Growth, And Possible Ways To Change The Tide,” published Aug. 5, 2014). Using Congressional Budget Office (CBO) data and other sources through 2014, we found income inequality was a drag on household income for those families left behind, as well as on long-run economic growthiii. When income inequality reaches extreme levels, many participants are excluded. With less money going into their bank accounts, they have less money to spend and invest, unless they rely on debt, which can be unsustainable, as the financial crisis of 2007-2008 made clear.

Conditions have worsened since then. A 2019 CBO report projecting changes in the distribution of household income through 2021 found that, while transfers and taxes still reduce inequality, household income is projected to be distributed less equally this year than it was in 2016 and 2017iv. According to the CBO, income inequality, as measured by the Gini coefficient, increased from 1979-2017v, and the CBO projects it will be higher in 2021 (see chart 2)vi. That increase reflects the accelerated growth of household income that is projected to occur at the top of the distributionvii. The reduction in inequality attributable to transfers and taxes is projected to be smaller in 2021 than it was in 2017viii.

Chart 2: Income Inequality As Measured By The Gini Coefficient, Since 1979

Income and wealth inequality are also a race issue. According to the Pew Research Center, since 1970 the gaps between two major racial and ethnic groups are sizable, with white and Asian people outearning Black and Hispanic people at all rungs of the income ladderix . The median household income for Black families remains 25% below that of white families and even further behind Asian families. Our analysis using IPUMS data highlights the growing gap in wages between white and Black women, and the growing divide in family income and wealth by race. After narrowing through 1980, the family income and wealth gap by race widened dramatically to $26,500 in 2019 (see chart 3). In line with our finding, according to the Brookings Institute, the net worth of a typical white family ($171,000) is almost 10x larger than that of a Black family ($17,150) in 2016x.

Chart 3: Family Income Gap Between Black And White College-Educated Women Professionals

Moreover, we found that as of 2016, college-educated Black students, men and women, carried a much larger share of student loans than other groups--including white, Asian, and Hispanic students--with Black students owing $7,400 more than their white peers, and the Black-white gap set to triple in the next few years, according to the Brookings Institutexi. Analyzing IPUMS data, we found that Black women often work in lower-paying service-sector jobs, regardless of whether they have college degrees (charts 4-5). Indeed, after the gap in annual wages between Black women and white women narrowed to just $744 by 1980, it widened dramatically to more than $5,300 by 2019 (see Appendix A). The wage gap for Black professionals widened even more, to $12,700, or 19 percentage points. This is roughly in line with the 21-point wage gap estimated by Lean In in its analysis on the gender pay gap for Black womenxii.

Chart 4: Wage Gap Between Black And White Women

Chart 5: Wage Gap Between Black And White Women Professionals

What if, instead, the U.S. broke that trend?

What if growth in Black women’s college education had matched that of white women from 1960-2019 (with all other factors constant, see Appendix A). In this hypothetical, we found that, starting in 1960, if Black women had kept pace with white women in graduating from college, there would have been another eight percentage points more college-educated Black women in the workforce by 2019--or 44.5% of working-age Black women with college degrees. That would be up from the 36% determined in the ACS (though still lower than the 49.3% for white women, given the different starting points).

As stated above, the closing of this education gap would have implications for the U.S. economy. Given how closely education is tied to productivity, more college-educated Black women would have added $107.45 billion over that time than without that education boost. And, if all the currently college-educated Black women had also been in positions that better matched their education and skill sets, the productivity boost would have generated a total $507 billion to GDP in that time.

But, education alone isn’t the cure-all. True advancement would require breaking down barriers.

Gary Becker’s human capital theory of 1964 posits that education develops skills that make workers more productive and that higher wage differentials for these workers relative to their less-educated counterparts reflect differences in productivityxiii. While this theory is generally sound, the reasons behind wage gaps, in practice, point to other sources of inequality--not the least of which is the social barriers many people of color facexiv. Outside research found that any view of inequality would include prejudice and discrimination as motivating factors and, therefore, associate labor-market disparities at least implicitly to an element of “unearned” allocation of resources to dominant groupsxv. This helps explain the still-large $7,600 (9.4%) wage gap that exists between Black and white professional women when we control for the quality of education.

Looking at the ACS data, we see that wages for Black women with college degrees are much lower than those for white women with the same credentials. One reason may be that the quality of college education for Black women, on average, may be lower than that of white women, thus restricting work opportunities. Another reason may involve affinity bias--the tendency of people to more closely connect with those who share similar backgrounds--that can translate into discriminatory hiring practices, consciously or not.

To be sure, there has been an increase in college attainment for Black women, although it has been much smaller than among white women. And this hasn’t been enough for Black women to achieve the same level of family income and wealth as white women. Several reasons could explain this gap, starting with inequalities experienced in childhood. “Neighborhood effect” is very strong in the U.S., and we see large differences in income and education across neighborhoods. Our data, and notable work by Harvard University economist Raj Chetty, shows that Black individuals living in low-income neighborhoods suffer disparities in childhood education and that this affects college outcomes.

A study by the St. Louis Federal Reserve shows that differences in students’ academic preparation prior to college can explain differences in college outcomes between Black and white studentsxvi. This includes information about households, class rank, and ACT scores. Research found that if these Black students lived in more-affluent neighborhoods during childhood, they would likely have had improved economic and health outcomesxvii. The lower family income for college-educated Black women may also be explained by low marriage rates relative to white women (see charts 6-7).

Chart 6: Share Of Parents Completing A Bachelor's Degree (By Parents' Education And Race/Ethnicity)

Chart 7: Percentage Of College Educated Women Who Are Married

This manifests in the link between job opportunities and education--a prime example being degrees in STEM (science, technology, engineering, and math) and the higher-paying fields they feed into. While STEM degrees have increased--among Black Americans, too--disparities persist. For example, a St. Louis Fed report by Cory Koedel, based on Missouri panel data on students who enrolled from 1996-2001, found the Black-white graduation gap in Missouri is 15.7 percentage points, and the STEM attainment gap is 4.5 pointsxviii. Similar trends can be found in other high-paying careers. And while the reasons for this certainly vary, the St. Louis Fed found that a lack of role models (teachers, family members) may discourage Black students from entering STEM and other more-elite fields, perpetuating the differences in economic outcomes between Black and white workers. In line with our analysis of ACS data, Black women have a higher graduation rate than Black men, at 51.8% and 42.2%, respectively. But the STEM attainment rate for Black women, at just 4.4%, is much lower than that of white women (6.5%), Black men (10.2%), and white men (16.7%).

Institution type is also an important factor in determining economic returns on college degrees. According to a 2018 Federal Reserve report, 5% of white young adults who attended college went to a for-profit institution, whereas among Black and Hispanic college-goers, the rate is nearly 3x higherxix (see chart 8). Keep in mind, for-profit institutions are in the business of providing a service (education) to make a profit for its shareholders, while nonprofit institutions (public and private colleges and universities) are publicly owned, managed by a board of trustees with no owners or shareholders to take into consideration--except for their students and constituents--and all revenues are reinvested into the institution. For example, Harvard is a nonprofit institutionxx.

The report showed that the value of higher education also differs by type of institution attended. For graduates with a bachelor's degree from public and private not-for-profit institutions, 71% and 64%, respectively, believed they reaped benefits from their education greater than the costs, dwarfing the 44% of graduates from for-profit institutions. And while Black students carry higher student debt levels than white students, the Brookings Institution found that their graduate degree completion rates seem to be lower, or at least slower, than white students. More debt with no degree is a bad combination for someone’s financial prospects later.

Chart 8: Schools Attended By Young Adults Age 22-29 (By Race And Ethnicity)

Few opportunities from for-profit colleges relative to other institutions help explain payment conditions, where about 23% of students who attended a for-profit college in 2017 were behind on student loan payments, in contrast to 9% at public colleges and just 6% at private nonprofit colleges (chart 9). According to a 2012 study by Harvard Professors David Deming, Claudia Goldin, and Laurence Katz, this may partly reflect the lower returns on degrees at for-profit schoolsxxi. Indeed, 26% of Black adults ages 18-29 with student debt were behind on their loans, about 3x the 9% rate for white student loan borrowers, according to the Fed. For all adults, 20% of Black people were behind in payments, more than 3x the 6% rate of white borrowers.

Chart 9: Payment Status Of Loans For Own Education (By Institution Type)

Generally, students who attend for-profit schools tend to be more nontraditional, less likely to have graduated high school, disproportionately older, female, Black, and more likely to be single parents--choosing these schools for the greater flexibility in scheduling classes. The larger share of Black students attending for-profit colleges, where the quality of education varies, will likely limit labor-market opportunities afterward. This is demonstrated in the comparatively large share of college-educated Black women in the services sector.

The historical survey data highlights that Black women with college degrees have worked predominantly in the lower-paying services sector, regardless of the changing times. Starting in the 1970s and helped by programs such as Title IX (1972), guaranteeing that no one can legally be excluded from an educational program based on gender, and the Women’s Education Equity Act (1974), white college-educated women began to make inroads into education and work opportunities, such as in the more-lucrative professional sector (see “The Key To Unlocking U.S. GDP Growth? Women,” published Dec. 5, 2017).

While these policies opened up educational opportunities to women and girls, the impact by race was mixed. According to the Women’s Sports Foundation, athletic opportunities for women of color grew at double the rate of those for white female athletes from 1971-2000. But female athletes of color remain underrepresented compared with their enrollment in the student body, and their participation is concentrated in two sports: basketball and track and field. Moreover, women of color are underrepresented in administrative and coaching positionsxxii.

Advances in household-appliance technology, the advent of the birth-control pill, and (perhaps most importantly) evolving attitudes about societal roles, including regulatory changes such as the Pregnancy Discrimination Act of 1978, also gave women greater freedom to work outside the home. (Family-care costs remain a constraint to a working mother’s job opportunities.) Beginning in the 1960s, the apparent entry points for college-educated white women in the workforce were mostly jobs in sales and clerical work. However, after peaking in the 1970s, jobs in this sector fell to 22.8% by 2019. The share in service jobs held at around 12%, as college-educated white women likely moved into the more-lucrative professional sector, climbing to 31% by 2019, from 4.3% in 1960 (chart 11).

Chart 10: Workforce Composition For Black Working Women

Chart 11: Workforce Composition For White Working Women

But, while regulation tied to the women’s movement may have paved the way for more education and job opportunities for American white women, ACS data suggests that Black women were largely left behind. In contrast to white women, college-educated Black women have made smaller inroads into the more-profitable professional sector, climbing to just 23% by 2019. That’s much larger than 8.4% in 1970, but a far cry from the 31% rate for their white counterparts. Discussed earlier, disparities in childhood education through to college outcomes leave Black women entering the jobs market on much weaker footing. As a result, college-educated Black women are much more likely to work in low-paying service jobs, with the share of college-educated Black women at 20.1% in 2019, almost double that of white women.

With more Black women, college-educated or otherwise, concentrated in the services sector, the COVID-19 pandemic hit this community much harder than it did other demographics. And while S&P Global Economics estimated in March that U.S. GDP will surge 6.5% this year--the largest increase in 37 years--it is not without scarring (see “Economic Outlook U.S. Q2 2021: Let the Good Times Roll,” published March 24). Indeed, we don’t see the unemployment rate getting back to precrisis levels until sometime in 2023.

Moreover, the economic and jobs landscape for a number of customer-facing services industries is still impaired. According to S&P Global Ratings, a number of leisure sectors won’t fully recover until 2023 or later. Service workers, particularly women and people of color, continue to bear the brunt of this pain. The unemployment rate for leisure and hospitality, at 10.1% in May, is about four points above precrisis levels, while rates for most professional jobs are near-normal, with the unemployment rate for financial services, at 3.00%, below its precrisis rate of 3.5%. This helps explain that the headline seasonally adjusted unemployment--at 5.7% in May, well below its recession peak of 14.8%--isn’t the same for everyone. The May unemployment rates for Black men and women age 20 and older, at 9.8% and 8.2%, respectively, are much higher than for white men and women, at 5.1% and 4.8%, and Hispanic men and women, at 6.7% and 7.4%. The unemployment rate for Asians also stood at a lower 5.5% in May.

The challenges Black women face didn’t materialize when the coronavirus pandemic began. The economic status of Black Americans has always been worse than average--with Black women suffering higher unemployment rates than both white men and women in the 49-year history of BLS monthly unemployment data by race (the same held true for Black men). Structural factors established after decades of discrimination have predisposed Black households in the U.S. to have, on average, suffered greater economic disadvantages than white, Hispanic, and Asian households--visible across median household incomes and homeownership levels.

Black workers have been perpetually underrepresented in executive positions but make up an outsize share of low-wage earners across the services sector and high-turnover entry-level positions elsewhere in the U.S. private sectorxxiv. S&P Global’s analysis of the U.S. Census Bureau's Current Population Survey (CPS) (2010-2019) and Brookings found that prior to the pandemic, Black families earned $66,905 in 2019--$16,115 less than white families’ $83,020 and coalescing in lower median household incomes than Asian families’ $92,785 and Hispanic families’ $75,435xxv.

As Black workers make up 12% of the entry-level workforce and just 7% of the managerial workforce, it could take 95 years for Black employees to reach parity across all levels in the private sector if the current trajectory continues, according to McKinsey & Co.

Black women have historically had the highest labor participation rate (LPR) among women, and remain at the top today, regardless of age, marriage status, or childrenxxvi. Using Bureau of Labor Statistics data back to 1972, the LPR for Black women peaked in 1999 at 66.9%, a seven-percentage-point gap relative to white women (see chart 12). The widest difference in LPR was in 1972, when the LPR for Black women, at 51.8%, was more than nine percentage points higher than for white women. Black women are also more likely to be a household’s sole income provider, with 56% of Black children living in a two-parent household in 2019, compared with 80% for white childrenxxvii.

Chart 12: Historical Labor Participation Rate, Women Age 20+ By Race, Ethnicity

This increases the economic burden on Black women, shown in their hours worked. After having been well above those of white women from 2000-2012, they have slowed dramatically since (see chart 13)xxviii. While Black female workers had historically regained the hours lost in earlier recessions, holding the lead in hours worked across race and ethnicity, Black female hours worked fell dramatically during the Great Recession, and through 2019, was never regained. Looking at hours worked for prime-age women ages 25-54 through 2016, the Economic Policy Institute (EPI) painted a similar picturexxix. Using Census CPS data through 2021, we found a significant loss in hours worked during COVID-19 across all groups, with Black women seeing a much larger percentage drop than their counterparts. Hours worked have since recovered though remain below precrisis levels.

Chart 13: Average Annual Hours Worked By Women Age 25-64

And, in line with our earlier analysis using the ACS data, Black women’s hours worked continue to be disproportionately in low-paying jobs. According to an EPI report, Black women’s annual work hours grew 22.3% for the bottom fifth of earners, but only 4.3% for the top fifthxxx. While work hours also increased, by 36.6% and 31.3% for white and Hispanic women, respectively, in the bottom-fifth wage percentile, both groups enjoyed much larger increases, of 19.4% and 17.0%, in the top fifth.

The pandemic forced many women to leave the job market, either to take care of children not in school or other family members, or for their own health reasons. But, while the LPR for Black women remains highest, the drop in their participation rate during the crisis was relatively more severe (see chart 14). In February 2020, the LPR among Black women was 63.9%, higher than the respective 58.2% and 61.9% among white and Hispanic women. A year later, Black women’s representation in the U.S. labor force had dropped to 59.7%--the lowest since 1993. With so much lost in the labor market because of COVID-19, Black women will likely see the slowest rebound in employment.

Chart 14: Impact Of COVID-19 On Female Labor Force Participation

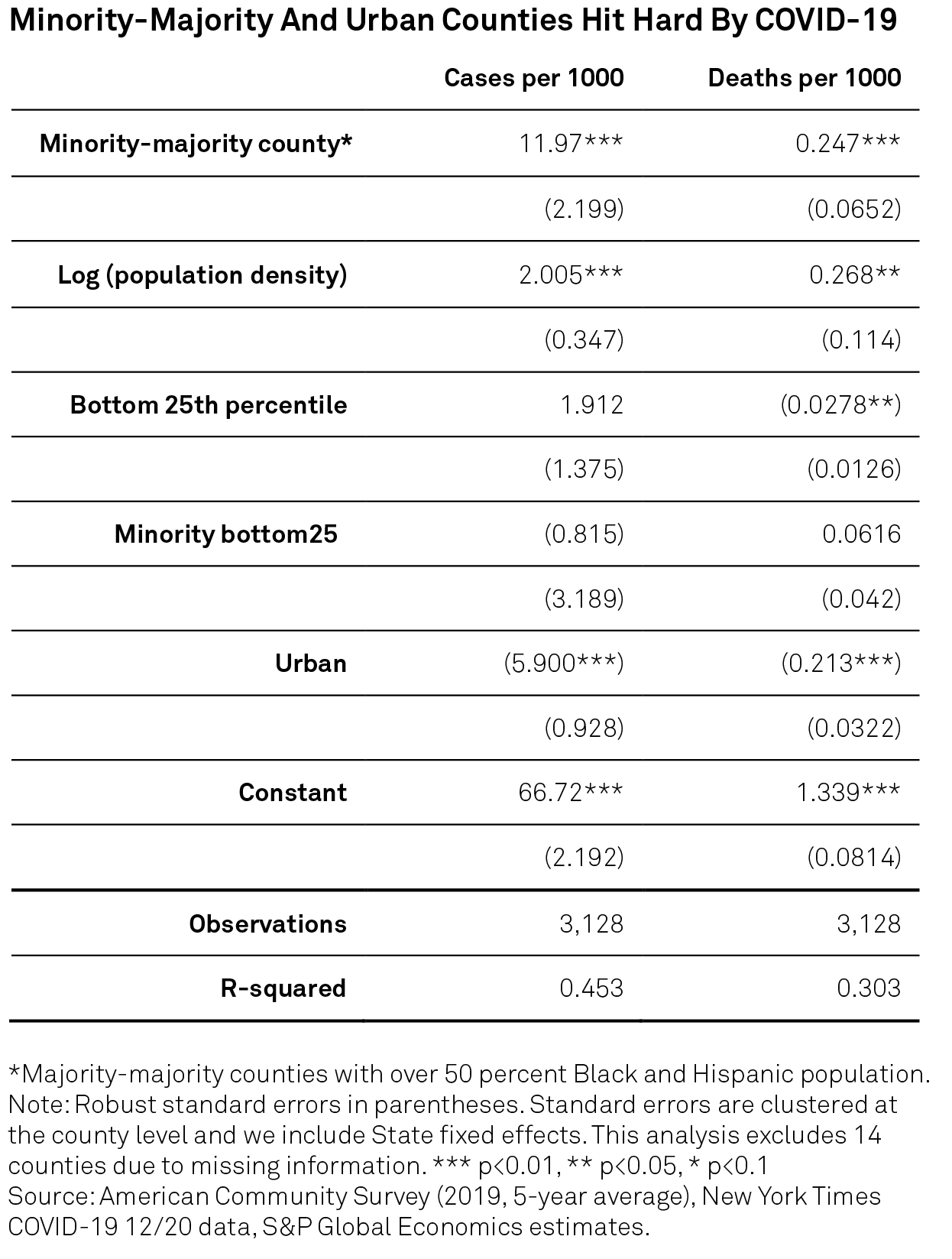

And few have been as hurt by the intersecting health, economic, and social crises as Black women, who are more than 3x as likely as white men to die from COVID-19, largely because of the inequitable socioeconomic conditions that have resulted in unequal access to health care and higher rates of comorbiditiesxxxi. Our analysis using both ACS and New York Times data also found that people living in U.S. counties with a minority majority (more than 50% Black and Hispanic) suffered much higher rates of COVID-19 cases and deaths.

Higher education is often considered a powerful tool in closing the racial economic gap and improving individuals’ mobility (see Appendix A). S&P Global believes the biggest springboard for Black women’s progress is equitable access to education, and truly equal opportunity will come only when we break down the structural and systemic barriers that obstruct Black women from succeeding in the American labor force.

Everyone benefits if more Black women are supported in accessing, funding, and completing valuable college education--since an increase in college education results in more Black women securing employment in high-skill sectors. This surge in labor force participation would ultimately enhance the U.S. economy’s overall productivity and growth.

Earlier policy initiatives have helped foster an environment that makes it easier for women to have children and stay in (or enter) the workforce, if they choose to. More recently, several cities and states have passed laws designed to prevent employers from underpaying women, barring companies from asking job candidates about their salary history or benefits, for example. While the federal Family and Medical Leave Act (FMLA) provides for unpaid leave, some states now require certain private employers to provide paid family leave. But, when considering race, results are mixed.

According to a Pew Research Center 2016 study, only 14% of civilian workers in the U.S. had access to paid family leave--not much higher than in 2010, when it was 11%xxxii. About 19% of state government workers had access to paid leave, versus 13% in the private sector. In the private sector, employees in finance, insurance, information services, and science and technology are the most likely to get paid family leave. Construction and hospitality/leisure fields (i.e., industries with a much larger share of Black and Hispanic employees) are much less likely to offer paid leave.

Building on the Trump Administration’s expansion of the federal child tax credit, doubling the maximum amount available and lifting income limits so more people could claim it, the Biden Administration’s recent infrastructure proposal includes provisions that would address some of the damage left by the pandemic that affects women and women of color. These include the modernization of schools and child care facilities; upgrades to child care facilities and the building of new supply in high-need areas; expanding access to affordable care for aging relatives; and supporting better-paying jobs that include benefits for caregivers, who are disproportionately women of color. Given Black women are also more likely to be the head of single-parent households, these families will likely benefit from this support.

As policymakers debate these and other proposals, one option to consider is a CBO-like "score" on the impact legislation would have on the economic feasibility and accessibility to the workforce for women. This is something we suggested when policymakers weighed various child care proposals in 2017. With labor participation for women, and Black women in particular, weakened to levels not seen in almost three decades, a simple, objective, nonpartisan measure that would equip lawmakers with the requisite tools to assess appropriate proposed legislation and its effect on women in the workforce would go a long way.

This has been done before. In its August 2010 analysis, the CBO considered the impact of the Affordable Care Act on how many workers would leave their jobs, and the workforce, once they had another viable health-care option. In the case of laying the groundwork for more-equitable outcomes for American Black women, such an initiative could reap a $507 billion reward.

If we want to spur the pace of growth in the world's biggest economy to its potential, underutilization of our greatest economic resource, labor, is no longer a viable option. Better educational opportunities for Black women is one option. But, true advancement would require breaking down barriers that can make it difficult, at best, for Black women to succeed in the American labor force.

Appendix A: Data Sources And Methodology

1. American Community Survey (ACS)

ACS is a randomly stratified survey administered by the Census Bureau every year. It is one of their largest surveys, covering approximately 2.5% of the households in the U.S. We use ACS data from 2000-2019 (latest wave available is 2019). We use county-level data, which includes demographic and economic variables at the county level for 3,220 counties.

2. IPUMS

We use IPUMS-USA metadata extract from 1940-2019. It is authorized by the Minnesota Population Center, affiliated with the University of Minnesota. This extract includes information at both the household and individual levels and contains technical, demographic, and economic characteristic variables. .

Source: Steven Ruggles, Sarah Flood, Sophia Foster, Ronald Goeken, Jose Pacas, Megan Schouweiler, and Mathew Sobek, IPUMS USA: Version 11.0. Minneapolis, MN: IPUMS, 2021.

3. Labor force participation and GDP data

We extract labor force participation rate and GDP per capita rate for the OECD countries from the OECD database. For female labor force participation, we also extracted data from national statistics of the respective countries as well as from the CEIC database.

4. Opportunity Insights

We used publicly available data from the race and neighborhood studies published by Raj Chetty and his coauthors. We used this data for the analysis of economic mobility in minority counties as well as by race.

Variable definitions

Methodology

1. Scenario 1: Closing the college gap

Assumption a: Based on the information on college attainment of Black and white women since the 1940s, we assume the college gap remained at the average between 1940 and 1960, which is approximately 5%. In our scenario analysis, we keep (or close) the college gap between Black and white women to 5% from 1960-2019.

Assumption b: Given the information from IPUMS data, we generate the variable on percentage of college-educated Black women who end up working in the professional sector. Once we generate the new number of college-educated women (based on assumption a), we use the same percentage to observe how many more college-educated Black women will now enter the labor force as professionals. This gives us the updated labor force.

2. Scenario 2: Closing the wage gap

Assumption: To understand where the wage gap between college-educated Black and white female professionals is coming from, we try to close the wage gap by adjusting for the quality of education. We assume that an improvement in the quality of education by 1 standard deviation should increase earnings by 9.6% (Chetty et al., 2011). Therefore, we close the wage gap by increasing earnings of Black college-educated professionals by 9.6%.

3. Scenario 3: Productivity boost to the economy

Assumption: To estimate the impact of this increase in college education of Black women on GDP, we assume an education-driven productivity boost of around 3% to the economy (Department of Labor), adjusted for the number of college-educated Black women relative to the overall size of the workforce. We control by the size of Black women in the workforce, relative to the overall workforce. We use this productivity boost to estimate the increase in GPD.

Appendix B: Impact Of COVID-19 On Black Communities

References

i Moya Bailey coined the term in her book “Misogynoir Transformed: Black Women’s Digital Resistance,” NYU Press, May 2021.

ii Steven Ruggles, Sarah Flood, Sophia Foster, Ronald Goeken, Jose Pacas, Megan Schouweiler, and Mathew Sobek, IPUMS USA: Version 11.0. Minneapolis, MN: IPUMS, 2021 (IPUMS).

iii CBO, “Projected Changes in the Distribution of Household Income, 2016 to 2021,” 2019; “The Distribution of Household Income, 2017,” 2020. Earlier reports include CBO, "Trends in the Distribution of Household Income Between 1979 and 2007," 2011; "The Distribution of Household Income and Federal Taxes, 2010," 2013; OECD, 2011; Jonathan D. Ostry, Andrew Berg, and Charalambos G. Tsangarides, "Redistribution, Inequality and Growth," IMF February 2014; Berg and Ostry, "Inequality and Unsustainable Growth: Two Sides of the Same Coin?," IMF April 2011; Berg and Ostry, "Equality and Efficiency," IMF September 2011.

iv CBO 2020. Income before transfers and taxes consists of market income and social insurance benefits (such as benefits from Social Security and Medicare) and excludes means-tested transfers and federal taxes. Means-tested transfers are cash payments and in-kind benefits from federal, state, and local governments that are designed to assist individuals and families who have low income and few assets. In this analysis, CBO classified means-tested transfers in four categories: Medicaid and the Children’s Health Insurance Program (CHIP), the Supplemental Nutrition Assistance Program (SNAP formerly the Food Stamp program), Supplemental Security Income (SSI), and other means-tested transfers. The other means-tested transfers that are analyzed in this report are housing assistance programs, low-income subsidies for Part D of Medicare (which covers prescription drugs), Temporary Assistance for Needy Families, child nutrition programs, cost-sharing reductions under the Affordable Care Act (ACA), the Low Income Home Energy Assistance Program, and state and local government general assistance programs. Federal taxes consist of individual income taxes (net of refundable tax credits, such as the earned income tax credit and the child tax credit), payroll taxes, corporate income taxes, and excise taxes.

v CBO 2019 and 2020 reports.

vi The Gini coefficient summarizes an entire distribution in a single number that ranges from zero to one. A value of zero indicates complete equality and a value of one indicates complete inequality.

vii Changes in federal government tax policy have exacerbated income inequality in recent decades. The federal income tax rate for the top income earners fell to 35% in 2012 and to 24% in 2021 from 70% in 1979, while the government hasn’t reduced the payroll tax rate except for the Payroll Tax Holiday of 2010, with was temporary.

viii Based on the CBO and 2020 reports. The payroll tax that funds Social Security is levied on pay below a certain threshold ($142,800 this year). In practice, this means that those earning less in wages than the cap, such as low-paying nonprofessional service jobs, pay a higher rate of Social Security tax than those who earn more than the cap. So, the composition of federal revenues has shifted away from progressive income taxes to less-progressive payroll taxes, and income taxes have become slightly more concentrated at the higher end of the income scale.

ix Rakesh Kochhar and Anthony Cilluffo, "Income gaps across racial and ethnic groups persist and, in some cases, are wider than in 1970,” Pew Research Center, July 12, 2018.

x Kriston McIntosh, Emily Moss, Ryan Nunn, and Jay Shambaugh, "Examining the Black-white wealth gap," The Brookings Institute, Feb. 27, 2020.

xi Judith Scott-Clayton and Jing Li, “Black-white disparity in student loan debt more than triples after graduation,” Oct. 20, 2016, The Brookings Institution. Richard Pallardy, “Racial Disparities in Student Loan Debt," Aug. 27, 2019, Saving For College.

xii LeanIn.org report https://leanin.org/data-about-the-gender-pay-gap-for-black-women#!

xiii Becker, G. S. (1994), Human capital revisited. "In Human Capital: A Theoretical and Empirical Analysis with Special Reference to Education," Third Edition (pages 15-28). The University of Chicago Press. Long, M. C. (2010). "Changes in the returns to education and college quality," Economics of Education review, 29(3), 338-347.

xiv Kampelmann, S., Rycx, F., Saks, Y., and Tojerow, I. (2018), "Does education raise productivity and wages equally? The moderating role of age and gender," IZA Journal of Labor Economics, 7(1), 1-37. Bureau of Labor Statistics. (1993). Labor Composition and US Productivity Growth, 1948-90. US Government Printing Office. St Louis Fed, "How should Labor Productivity be Measured?," On The Economy Blog, March 3, 2015. Berger, N. and Fisher, P. (2013), "A Well-Educated Workforce Is Key to State Prosperity," Economic Policy Institute, 22(1), 1-14.

xv Ibid

xvi Cory Koedel, "Explaining Black-White Differences in College Outcomes at Missouri Public Universities," Federal Reserve Bank of St. Louis Review, First Quarter 2017, 99(1), pages 77-83.

xvii Chetty, R., Friedman, J. N., Hilger, N., Saez, E., Schanzenbach, D. W., and Yagan, D. (2011), "How does your kindergarten classroom affect your earnings? Evidence from Project STAR," The Quarterly journal of economics, 126(4), 1593-1660. In his paper on project STAR, Harvard professor Raj Chetty finds that during the kindergarten years, improving the class quality by one standard deviation of the distribution within schools raises earnings by approximately 9.6% at age 27. Under those assumptions, this translates into a lifetime earnings gain of $39,100 for the average individual.

xviii Koedel, Cory, "Explaining Black-White Differences in College Outcomes at Missouri Public Universities," Federal Reserve Bank of St. Louis Review, First Quarter 2017, 99(1), pages 77-83. Black graduation rate was 48.2 percentage points (pp), while the white graduation rate was 63.9 pp.

xix Board of Governors of the Federal Reserve System (2018), "Report on the Economic Well-Being of U.S. Households in 2017," May 2018.

xx S&P Global Ratings' criteria for rating not-for-profit public and private universities applies to the assignment of issuer credit ratings, stand-alone credit profiles, and issue credit ratings to not-for-profit public and private colleges and universities globally. See "Methodology: Not-For-Profit Public And Private Colleges And Universities," published Jan. 6, 2016 (https://www.capitaliq.com/CIQDotNet/CreditResearch/SPResearch.aspx?articleId=&ArtObjectId=9389754&ArtRevId=11&sid=&sind=A&). The criteria do not apply to for-profit entities that exist to benefit private shareholders, even if they operate in the same market as not-for-profit universities. Such corporations are evaluated using "Corporate Methodology," published Nov. 19, 2013 (https://www.capitaliq.com/CIQDotNet/CreditResearch/SPResearch.aspx?articleId=&ArtObjectId=8314109&ArtRevId=17&sid=&sind=A&).

The criteria define a public university as one having the following characteristics: in the U.S: established by governmental action and subject to related government rules and regulations, and receives regular and ongoing funding from a government for operating purposes; or outside the U.S: receives government financial support and operates within a regulatory framework. A nonpublic university is considered to be private. Private not-for-profit universities retain surplus revenue within the organization for the benefit of the university's mission without the consideration of owners or shareholders. Within the U.S., not-for-profit universities have tax-exempt status.

xxi Deming, D. J., Goldin, C., and Katz, L. F. (2012), "The for-profit postsecondary school sector: Nimble critters or agile predators?," Journal of Economic Perspectives, 26(1), 139-64.

xxii Female athletes of color make up 26.2% of the female student population but receive 17.5% of the total female athletic opportunities. In contrast, white females are 68.5% of the female student population and receive 75% of the total female athletic opportunities. 17% of college athletic directors are women, yet only 1.7% (15 out of 885) are women of color. One-third (34%) of senior administrative posts (associate and assistant athletic directors) are women, yet only 3.2% are women of color. Source: Women’s Sports Foundation, “Race And Sport,” www.WomensSportsFoundation.org.

xxiii Jones, J. (2021), "A More Inclusive Economy is Key to Recovery," U.S. Department of Labor Blog.

xxiv McKinsey & Co., Race In The Workplace. "The Black Experience In The US Private Sector," February 2021.

xxv The Middle Class Monitor of Brookings.

xxvi Gould, E. L. and Rawlston-Wilson, V. (2020), "Black workers face two of the most lethal preexisting conditions for coronavirus--racism and economic inequality," Economic Policy Institute.

xxvii McKinsey, February 2021.

xxviii Analysis uses weeks worked data from the IPUMS. Categories include: Black, white, Asian (includes Japanese and Chinese), other includes Hispanics, Pacific Islanders (PI), not in chart, includes natives.

xxix Valerie Wilson and Janelle Jones, "Working harder or finding it harder to work," EPI, Feb. 22, 2018.

xxx Nina Banks, "Black women’s labor market history reveals deep-seated race and gender discrimination," EPI Feb. 19, 2019.

xxxi Rushovich, T., Boulicault, M., Chen, J. T., Danielsen, A. C., Tarrant, A., Richardson, S. S., and Shattuck-Heidorn, H. (2021), "Sex Disparities in COVID-19 Mortality Vary Across US Racial Groups," Journal of General Internal Medicine, 1-6; Harvard University, 2021; McLaren, J. (2020), "Racial Disparity in COVID-19 Deaths: Seeking Economic Roots with Census data" (No. w27407), National Bureau of Economic Research; Chakrabarti, R., & Nober, W. (2020), "Distribution of COVID-19 Incidence by Geography, Race, and Income" (No. 20200615), Federal Reserve Bank of New York.

xxxii Juliana Menasce Horowitz, Kim Parker, Nikki Graf, and Gretchen Livingston, "An inside look at family and medical leave in America: The experiences of those who took leave and those who needed or wanted to but couldn’t," Pew Research Center, March 23, 2017.

The views expressed here are the independent opinions of S&P Global's economics group, which is separate from, but provides forecasts and other input to, S&P Global Ratings' analysts. The economic views herein may be incorporated into S&P Global Ratings' credit ratings; however, credit ratings are determined and assigned by ratings committees, exercising analytical judgment in accordance with S&P Global Ratings' publicly available methodologies.