Discover more about S&P Global’s offerings

Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer LoginsContents

China's economic growth and geopolitical challenges

China economic outlook

China's economic development has continued to slow, leading to a drop in mainland China's growth and raises the risk that its economy will become ensnared in a middle-income trap. According to industry analysts, trade disputes, technology restrictions and escalating tensions may raise geopolitical risks geopolitical risks in China.

According to S&P Global, the China economic growth will likely remain weak in 2023 and 2024. In response to the weakening economic recovery, the government will continue to increase stimulus measures. Under the current economic malaise caused by low household and business confidence, fiscal stimulus will be more effective than monetary easing. More importantly, a creditable retreat from heavy-handed intervention policies will be crucial.

The economy is also impacted by external demand, however this pressure decreased in August 2023. Goods exports fell 8.8% year over year in the month, moderated from a 14.5% drop in July. Of China’s major external markets, demand from Europe weakened the most severely.

The demand for investments will continue to be weak due to declining infrastructure investment and low confidence among private companies. The latest policy support measures should only stabilize the economic downturn but are insufficient to induce a robust recovery, given weak private sector confidence.

The deflation risk exists but should not be exaggerated. Moderating but still growing Chinese consumer demand, monetary easing, and excess supply reduction owing to industrial sector weakness should prevent a deflationary spiral.

From neighborhood to nation, we have you covered. Explore Regional Explorer for the economics, risk, and data analytics you need to make confident decisions.

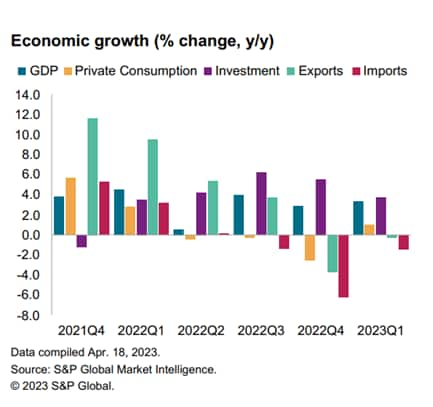

China’s economic growth, percentage changes year to year from 2021-2023

China’s economic growth is uneven and unsteady

Uneven recovery in both supply and demand. Since mainland China relinquished its zero-COVID policy at the end of 2022, economic recovery has been uneven. Sectors hit hardest by zero-COVID measures have rebounded fast, whereas segments of the economy that functioned relatively normally under pandemic controls have rebounded slowly. On the supply side, such dynamics are evident in the fast rebound of the service sector and the sluggish recovery of the industrial sector. On the demand side, they are manifested in a more vigorous rebound in consumption relative to the rebound in investment.

Sharp rebound in the hard-hit segments of the economy. The hospitality, transportation, and real estate industries saw the biggest recoveries within the service sector; these industries' activities were the worst hit by pandemic controls or regulatory crackdowns. Consumer markets have witnessed the highest advances in the areas, such contact and mobility services, where consumers were most adversely affected by pandemic limitations.

Struggles with housing market recovery. Mainland China’s housing market downturn had shown signs of recovery in downstream activities. Housing construction completion, sales and mortgages have all returned to growth in early 2023 on the back of policy support. However, these improvements have failed to induce a recovery in housing starts, which have remained in deep contraction. In addition, the rise in property prices has stumbled.

Unbalanced labour market recovery. Since pandemic controls expired, the labour market has generally seen a modest improvement. At the end of 2022, the urban unemployment rate fell from 5.5% to the low-5% range However, after the economy reopened, the youth unemployment rate Given that young workers are more likely to be consumers, rising youth unemployment inhibits a recovery in consumer demand. Their rising employment challenges are likely to delay starting families, which will have a negative impact on both the demand for homes and birth rates.

Modest dose of stimulus. Although the suspension of pandemic control measures was a sign that policy might change to boost the economy, the stimulus since reopening has been small. Total social finance, the broadest indicator of mainland China's liquidity, has grown at a slower rate than it did at the end of 2022, most likely because of consumer caution towards debt accumulation countering state-owned firm borrowing strength. The growth of infrastructure investment has also slowed.

China’s economy - Global impact

Chinese imports is the world’s second largest goods importer, accounting for close to 11% of the world’s goods imports in 2022. Mongolia (83.9%), the Democratic Republic of the Congo (54.4%), Vietnam (27.5%), and Laos (26.5%) had the highest trade exposure to mainland China in terms of goods exports to China as a proportion of GDP exceeding 25% in 2022. The G20 economies with the highest exposure to mainland Chinese demand in 2020 (in terms of exports to mainland China as a share of GDP) included South Korea (11.4%), Saudi Arabia (8.8%), Australia (8.0%) and Indonesia (6.6%).

The wobbly economic recovery is unlikely to cause mainland China to retrench its external lending. Mainland China’s foreign lending is largely based on geopolitical rather than commercial considerations. Since President Xi Jinping assumed office in 2013, mainland China’s external lending has grown by an average annual rate of 12.3% and has not contracted in any single year. Moreover, mainland China’s external lending is manageable given its relatively small size. External lending (excluding reserve assets, account receivables and trade credit) totaled US$1.65 trillion at the end of 2022, or 9.2% of the Chinese GDP.

The Chinese government has officially acknowledged the need for significant policy support to bolster business confidence and affected households. Therefore, lifting domestic demand, particularly Chinese consumer demand was identified by President Xi Jinping, as the top economic objective for 2023 in his speech at the Central Economic Work Conference in mid-December 2022. Xi also acknowledged the necessity of expanding state investment to spur investment recovery, contributing to China’s economic growth.

Regional administrations disclosed their 2023 targets for their regional economies in the run-up to the National People's Congress in March. At the Congress itself, the central government released a variety of China’s economic goals for the year 2023. Ten regions set their 2023 fixed asset investment (FAI) growth objective lower than their region's actual FAI growth rate in 2022, out of the 25 provincial-level regional governments that have published their 2023 economic plans. The regional governments' cautious FAI targets reflect limited financial resources, the property-sector downturn and weakened sentiment in regional business communities.

China’s oil supply

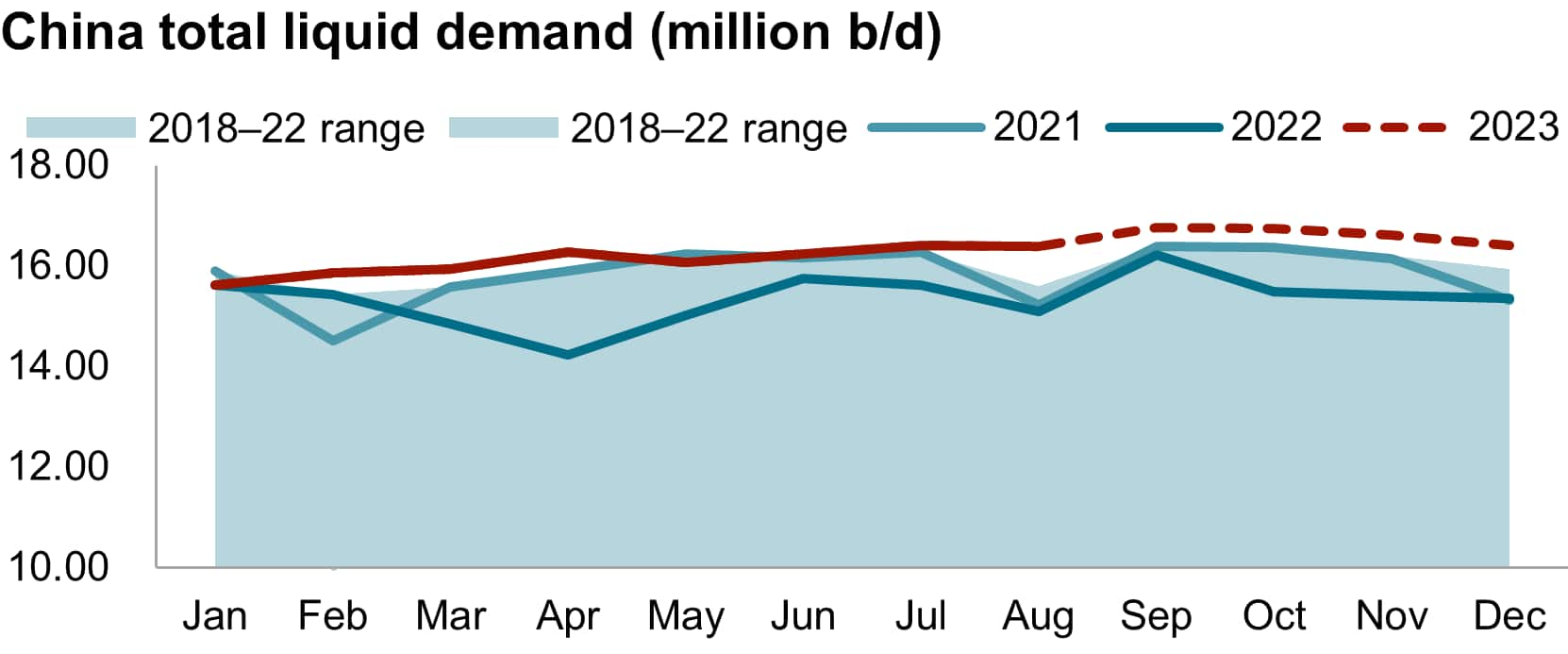

China’s oil supply demand growth was projected to reach approximately 940,000 b/d in 2023, before decreasing to 480,000 b/d in 2024

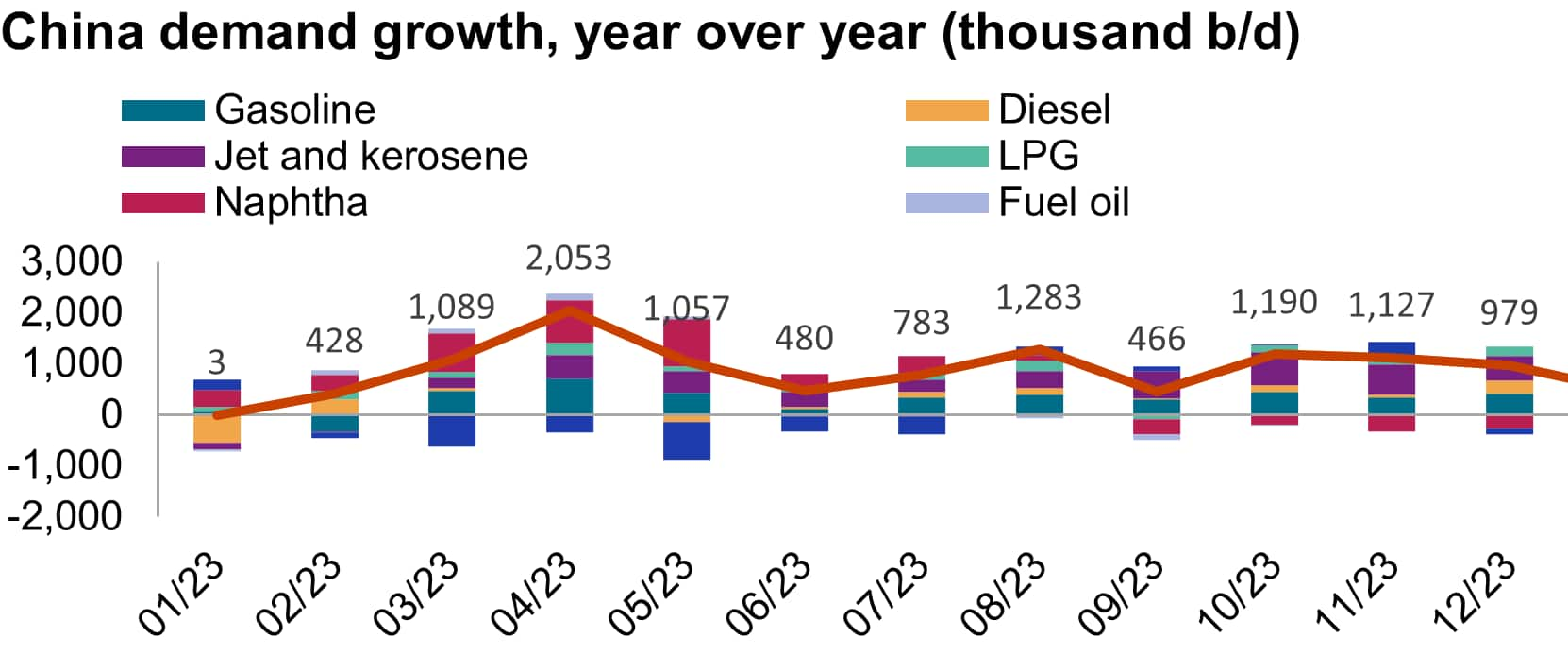

In August 2023, the Chinese oil demand experienced a year-over-year increase but was slightly lower than the previous year due to a decrease in petrochemical feedstock demand. Total demand decreased by 23,000 b/d month over month and increased by 1,282,000 b/d year over year. Seasonal demand is expected to continue in September and October, driven by agriculture, industry, and construction, but the month-over-month growth rate may be weaker than historical patterns due to current macroeconomic performance.

Gasoline and jet/kerosene fuel oil demand from the tourism industry is projected to rebound during the Mid-Autumn Festival and National Day, spanning from late September to early October, only to decline thereafter. Meanwhile, international flights are expected to continue the current steady recovery, from a low basis at approximately 50% of pre-COVID-19 demand now.

Diesel demand is expected to peak in September and October but may be below the five-year historical average due to investment in macroeconomics and export pressures.

Naphtha demand is expected to rebound in the fourth quarter. In the petrochemical sector, despite strong paraxylene (PX) profits, cracker profitability remains weak. However, due to winter heating demand supporting liquefied petroleum gas prices, naphtha demand is anticipated to increase month over month.

On an annual basis, we expect total oil demand to increase by 6.1%, or 940,000 b/d, year over year in 2023 and to increase by 2.9% in 2024.

We lowered our forecast for oil demand in 2024 to 480,000 b/d, mainly due to a weak macro-outlook.

China total liquid demand (million b/d)

China oil demand growth, year over year (thousand b/d)

After September 2023, headwinds mount on crude runs. Despite the usual seasonal uptick in crude oil processing in the fourth quarter, we anticipate a quarter-over-quarter crude runs growth limitation to about 100,000 b/d or lower, a marked shift from the historical growth range of 300,000 b/d-600,000 b/d.

China’s refining margins are declining due to product oil prices lag crude oil prices from September 2023 onward. This lag is due to unmet peak demand expectations and wholesalers’ unwillingness to restock in a bearish market. Some swing producers have reduced utilization or halted operations pre-peak season end.

Furthermore, the absence of new product export quotas in China this year is expected to result in a significant decrease of at least 30% in product oil exports, bringing the total below 700,000 b/d in the fourth quarter, impacting the China oil exports. This decline will have a direct impact on crude runs, reducing them by approximately 400,000 b/d. Moreover, the lack of new crude import quotas is likely to further contribute to reductions in year-end crude oil runs. Although state-owned refineries have the capability to compensate for the decrease in crude runs, this is dependent on demand and requires a time-consuming feedback cycle.

The China crude oil production runs are expected to experience a substantial annual increase of 1.14 million b/d in 2023, according to projections. Despite recent challenges, data from S&P Global Commodity Insights reveals a year-over-year growth of 1.3 million b/d for the first nine months, indicating the resilience of China’s crude runs from January 2023 to September 2023.

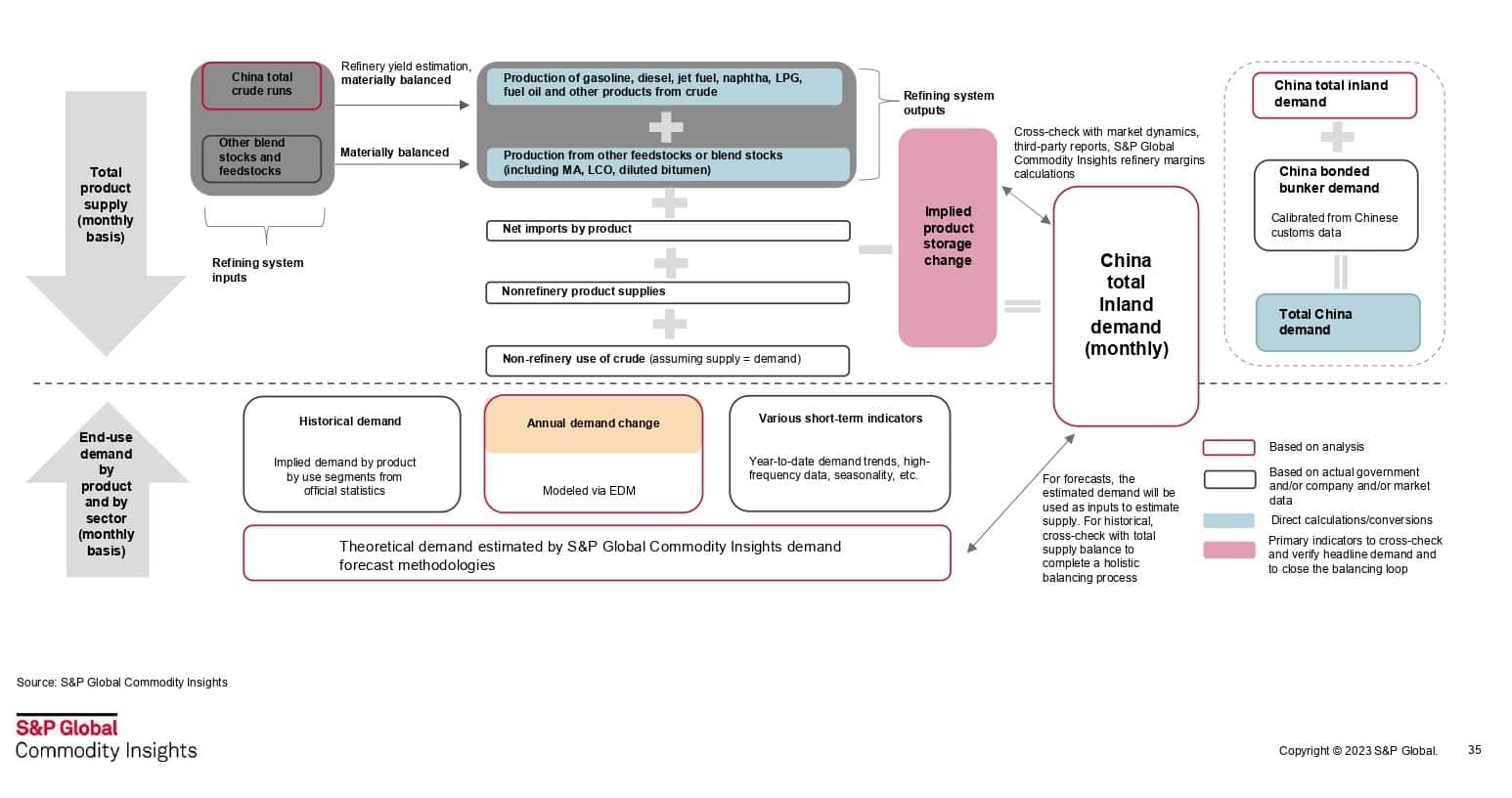

China’s product demand assessment methodology: Multiple indicators are selected to draw estimations for, and to back-check, product demand

A world rebalancing – Five themes driving the economics and risk outlook in 2023

US-China relations

Trade disputes and tariffs imposed in recent years appear to have affected diplomatic relations between the US and China. Trade restrictions could harm global economic growth. Economists believe that both tariff-imposing countries and countries subject to tariffs suffer losses in economic welfare, while non-tariff countries sustain collateral damage. China and the US officials have both expressed a desire to alleviate trade tensions. Key issues for negotiation include market access, intellectual property rights and joint venture technology transfer.

During China’s 20th Party Congress in 2022, President Xi Jinping appeared to suggest that he is prioritizing China’s economic security over economic growth. One way to achieve economic security is to reduce reliance on trade relationships and reduce vulnerability to external pressures.

While the current Biden administration has expressed a desire for trade talks, the US has also announced additional limitations on the export to China of advanced semiconductor technologies. Semiconductors are seen as a key area of strategic competition between the two countries.

Another area of strategic competition between China and US is in materials and components necessary to meet ambitious targets for the deployment of solar, batteries and electric vehicles. China controls much of the world’s mining and production of elements related to the energy transition. The US, EU and other G7-aligned countries are dependent on Chinese exports of these materials. Limitations in supplies of these materials are likely to affect the progress of building out lower-carbon energy and automotive sectors.

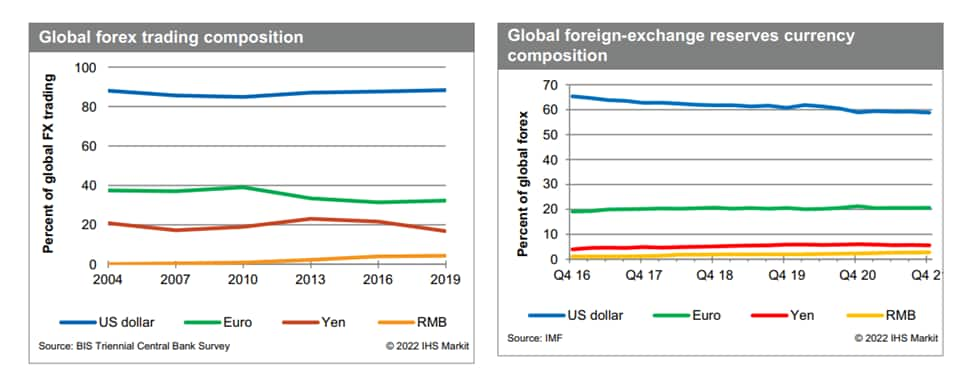

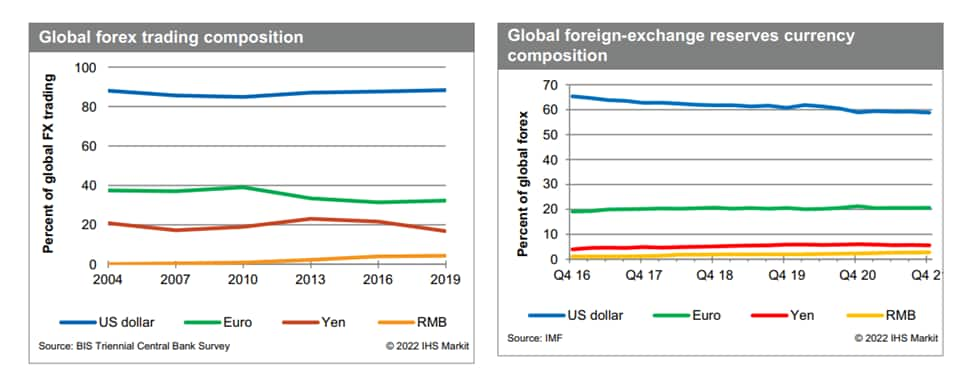

Prospects and impact of De-Dollarization

U.S. led sanctions following the Russian invasion of Ukraine have strengthened concerns in some countries around the US dollar as the global reserve currency. Many economists, including those at S&P Global Market Intelligence believe the renminbi is unlikely to replace the US dollar in the global financial system soon.

Renminbi internationalization is one of multiple requirements for the renminbi to achieve major reserve currency status. Other prerequisites for the home country of a major reserve currency include:

- Free-floating exchange rate. The home country’s currency is traded freely with a market-determined exchange rate.

- Fully convertible currency. The home country’s currency has full convertibility (open capital account) – that is, capital can flow freely into and out of the home country without any official restrictions.

- Economy size. The home country of a major reserve currency should have a large economy with sizeable shares in international trade and finance.

- Stable macroeconomic policies. The home country has a long history of stable and credible macroeconomic policies that maintain low inflation and public debt sustainability.

- Developed financial market. The home country possesses well-developed and deep financial markets that provide ample safe financial assets to be held by foreign investors. A well-developed and robust financial market is also necessary for the home country’s currency to be fully convertible.

Global forex trading composition and global foreign currency exchange composition Q4.

China’s economic recovery has been uneven, as the transition from investment-fueled development to one based on consumption faces challenges. The government, which has refrained from taking drastic efforts to stimulate demand, is still heavily reliant on infrastructure spending to spur investment and economic growth.. From a predominantly agrarian economy to one of the major manufacturing and consumer marketplaces in the world, the nation has seen a tremendous shift. However, the transition from a US-led global economy to an emerging, potentially multipolar reality has resulted in tensions that threaten to undermine the positive effect of global trade. Companies operating in this shifting geopolitical context must take account of risks that impact supply chains, currencies, and global economic growth.

We can help you navigate the economic, geopolitical, and trade shifts coming.

<span/>Global economics research and analysis

Looking for global economics products and solutions?

Advanced Country Analysis and Forecast

Enhance your business plans with unparalleled risk analysis and the economic forecast

How tariffs flow through economic models

Understand what tariffs do to economies and how they flow through an economic model.

China Economic Forecasts and Risk Ratings

Mainland China’s economic growth soared in the first quarter of 2021, owing to continued recovery and extreme low base effect.

US Economic Service: Short-, mid- and long-term forecasts

Access the most detailed macroeconomic outlook of the US economy. Powered by Macroeconomic Advisers by S&P Global, this service provides the immediate-to-long-term US economic forecast – organized to help government agencies, corporations and financial institutions make smart investment and management decisions.

World Economic Service

Evaluate business opportunity and risk with the long-term global economic forecast. Successful business decisions require a thorough understanding of the macroeconomic context and outlook. The World Economic Service equips decision makers to meet this challenge with economic data and 30-year forecasts for up to 500 indicators across more than 200 countries.

China Regional Service from Market Intelligence: China Analysis & Outlook

Looking to expand operations in China? Explore China’s economic outlook to enhance your strategy and operations in China with comprehensive risk analysis, quality research, and data insights.

The S&P Global China Credit Analytics Platform

Your one-stop for advanced credit insights on Chinese public and private companies, bond issuers, and government-related entities (GREs).

Global economics FAQs

{}

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fen%2fenterprise%2fgeopolitical-risk%2fglobal-economy-in-china%2f","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fen%2fenterprise%2fgeopolitical-risk%2fglobal-economy-in-china%2f&text=Global+Economy+in+China+%7c+S%26P+Global","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fen%2fenterprise%2fgeopolitical-risk%2fglobal-economy-in-china%2f","enabled":true},{"name":"email","url":"?subject=Global Economy in China | S&P Global&body=http%3a%2f%2fwww.spglobal.com%2fen%2fenterprise%2fgeopolitical-risk%2fglobal-economy-in-china%2f","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+Economy+in+China+%7c+S%26P+Global http%3a%2f%2fwww.spglobal.com%2fen%2fenterprise%2fgeopolitical-risk%2fglobal-economy-in-china%2f","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}