Market Implications

Impact of The Recent Financial Conduct Authority LIBOR Announcement on the Structured Finance Market

The announcement of LIBOR cessation would trigger the spread adjustment to be fixed as a component of the LIBOR fallback rate for derivatives contracts with fallback provisions governed by ISDA. For legacy non-consumer cash products referencing USD LIBOR, this fixed spread adjustment would be added to a form of SOFR to replace USD LIBOR as recommended by the ARRC. Despite the potential delay of USD LIBOR cessation to mid-2023, U.S. regulators are encouraging no new USD LIBOR contracts after the end of 2021, while allowing most legacy contracts to mature before USD LIBOR stops.

On derivatives contracts, progress has been made in LIBOR transition with the ISDA 2020 IBOR Fallbacks Protocol having taken effect on Jan. 25, 2021. The other milestone in listed derivatives’ LIBOR transition also took place on Jan. 25 when CME provided details on proposed methodology for transitioning Eurodollar futures and option contracts. On cash products, the ARRC has recommended fallback language for floating-rate notes, bilateral business loans, syndicated loans, and saucerization products for market participants’ voluntary use.

Market Updates on the LIBOR Transition

This year will be key in the London Inter-Bank Offered Rate (LIBOR) transition. After consultation on ending the publication of LIBOR in USD, GBP, EUR, CHF, and JPY, the administrator of LIBOR, the ICE Benchmark Administration (IBA), may announce its decision soon.

The announcement of LIBOR cessation would trigger the spread adjustment to be fixed as a component of the LIBOR fallback rate for derivatives contracts with fallback provisions governed by ISDA.

For legacy non-consumer cash products referencing USD LIBOR, this fixed spread adjustment would be added to a form of SOFR to replace USD LIBOR as recommended by the ARRC.2

Read the Full ArticleThe global transition to a series of replacement reference rates will be a steep challenge. A key question is: how will benchmark replacement affect credit ratings?

ACCESS THE TOPIC PAGELIBOR to SOFR

Understanding SOFR

In June 2023, the U.S. dollar London Inter-Bank Offered Rate (LIBOR) will likely be discontinued. The Alternative Reference Rates Committee has identified the Secured Overnight Funding Rate (SOFR) as the recommended alternative reference rate to replace USD LIBOR.

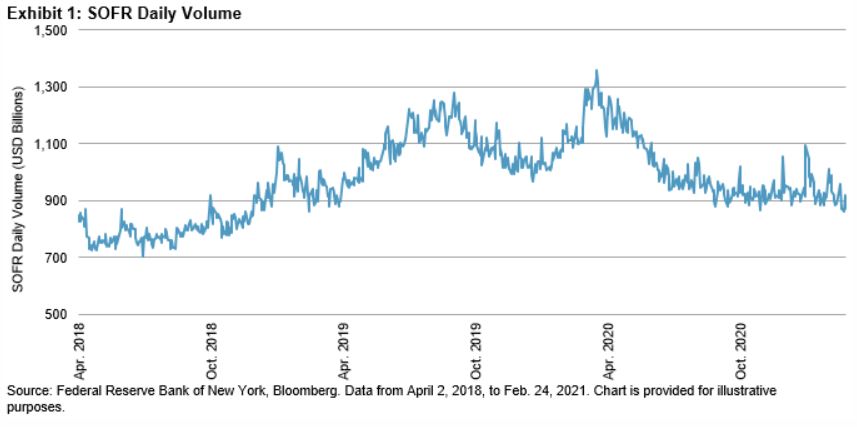

SOFR is calculated as a volume-weighted median of transaction-level U.S. Treasury repurchase agreements data, reflecting borrowing cost in overnight borrowing collateralized by U.S. Treasury securities.

One difficulty is that in the absence of SOFR-based term rates, SOFR compounded in arrears currently is the preferred replacement rate in many products. Calculated over the current interest period, it leaves little notice time before payment and poses significant operation disadvantages for some cash products.

LIBOR Transition Enters Crunch Time in 2021

More than a decade since manipulation of LIBOR triggered regulatory investigations and, ultimately, billions in fines, the rate remains the financial world's favored benchmark.

Read the Full ArticleSOFR Emerging as Alternative to LIBOR In U.S. Debt Markets

Based on data from the Federal Reserve Bank of New York and earlier repo transaction data since the late 1990s, SOFR has been tracking closely with dollar LIBOR.

The historical time series analysis between the two benchmark rates shows a positive average and median of LIBOR over SOFR. Because only daily SOFR rates currently exist, compounding is typically used for this new rate and helps smooth out most of the volatility in daily rates.

Read the Full Report

APAC

Japanese Securitizations: Time Ticking On LIBOR Transition

Japanese securitizations could find losing LIBOR laborious.

Japanese yen LIBOR announcements will be discontinued at the end of 2021; discussions on replacements among securitization transaction parties are accelerating in Japan.

Losing LIBOR: Australia Banks on A Smooth Transition

Australia's banks are on track for a smooth shift away from interbank offered rates (IBOR) to alternative risk-free reference rates by the end of 2021.

Like their international counterparts, the move poses challenges for Australia's lenders, but a robust local benchmark tempers the risks, in S&P Global Ratings' view.

Unlike in the U.S. and Europe, Australia's regulators are not proposing a wholesale shift to referencing an alternative risk-free rate. This is because the Bank Bill Swap Rate (BBSW)--the Australian IBOR benchmark--remains robust.

Read the Full ReportStay up to date with the latest news and insight from S&P Dow Jones Indices on LIBOR.

ACCESS THE TOPIC PAGEAmericas

With LIBOR Transition Approaching In U.S. CLOs, Fallbacks Remove Some Uncertainty

The LIBOR transition may have been extended, but it's not going away. U.S. regulators have indicated that banks should stop using LIBOR in new issue contracts by December 2021. This means the leveraged loan and collateralized loan obligation (CLO) markets are expected to see significant changes in interest rates during 2021 as borrowers and lenders come to terms with new risk free rates, such as SOFR, together with spread adjustments, floor considerations, and related changes.

Legacy CLO transactions should have additional time to make the shift toward new rates based on the recent announcement from the Financial Conduct Authority that most dollar LIBOR settings will cease after June 2023. At year-end 2020, S&P Global Ratings had about 870 rated U.S. CLOs from 140 managers outstanding, with origination dates ranging from 2006 through Dec. 30, 2020. Within these CLO indentures, there are a variety of document provisions related to how a potential LIBOR transition should be handled.

Latin America Structured Finance Outlook 2021: New Issuance Should Increase Amid the Challenging Environment

S&P Global Ratings expects Latin American structured finance issuance to increase modestly to $15 billion in 2021. Brazil will continue to drive new issuance in the region. Despite the increase in negative rating actions in the region, credit-enhancement levels should continue to lead to stable ratings performance in most asset classes. Nevertheless, the economic environment in the region remains very challenging. S&P Global Ratings will continue to focus on the pandemic's impact on collateral performance, particularly for ABS transactions.

The region´s exposure to LIBOR is minimal.

As part of its surveillance of rated transactions affected by the phase-out of LIBOR, S&P Global Ratings expect to receive amendments to transaction documents that reflect replacement benchmarks elected by the transaction parties in a timely manner.

Read the Full Report

EMEA

European Structured Finance Market Accelerates Transition From LIBOR

The transition from the British pound sterling London Interbank Offered Rate (LIBOR) is gaining momentum in Europe's structured finance market, ahead of the phase-out date at year-end.

S&P Ratings expects the transition process across rated transactions to speed up this year, though with significant variation.All of the affected European structured finance notes that S&P Global Ratings rates contain fallback provisions that allow for replacement of the benchmark rate. For seasoned transactions, replacing LIBOR generally requires explicit consent from three-quarters of the noteholders, which seems feasible in practice.

However, about 20% of transaction documents contain relatively weak fallback provisions, which could lead to payment disruption if the benchmark is not replaced before the LIBOR end date. Questions also remain for legacy contracts, especially individual loan agreements contained in the underlying collateral, which was mostly originated in the U.K.

UK Regulators Remind Companies of Need to Transition Away from LIBOR by 2021-End

The Bank of England and the U.K. Financial Conduct Authority reminded firms of the need to transition away from LIBOR by 2021-end, having recommended the use of alternative reference rates, such as the sterling overnight index average rate, or SONIA

Read the Full ArticleLosing LIBOR: Most European Banks are Unlikely to Face A Cliff Edge

S&P Global Ratings believes the planned introduction from Jan. 1, 2022, of new interest rate benchmarks regarded as transparent, risk free, and transaction based, will be a positive move for Europe's financial markets.

Regulators, banks, clearinghouses, and other bodies are working together to find ways to minimize transition risks for market participants, so S&P Global Ratings doesn’t anticipate widespread systemic disruptions.

Read the Full ReportEven as signs of normalization from the coronavirus-caused economic downturn sprout across countries, the pandemic is pressuring global banking sectors as they balance declining asset quality & creditworthiness with increasing demand for lending.

ACCESS THE TOPIC PAGE