At S&P Global Ratings we are continuously assessing the economic and credit impact of the COVID-19 pandemic around the world. Subscribe to our Coronavirus Bulletin today and we will ensure you have all our latest research and forecasts as they are published.

Subscribe to the NewsletterHurricane Preparation

Utilities Optimistic COVID-19 Will Not Hamper Hurricane Recovery Efforts

COVID-19 is creating logistical challenges for utilities along the Eastern seaboard and Gulf Coast for the 2020 Atlantic hurricane season.

Key Takeaways

- The National Oceanic and Atmospheric Administration has forecast that the 2020 Atlantic hurricane season will likely be busier than usual and could include up to six major Category 3 or higher storms.

- To limit the spread of the virus during storm recovery efforts, utilities plan to adopt the U.S. Centers for Disease Control and Prevention's recommended safety, social distancing and health screening measures.

- Further complicating matters, the utilities could end up competing with evacuees and disaster aid groups for lodging more than what was the case in the past thanks to COVID-19.

North America

North American Regulated Utilities Face Tough Financial Policy Tradeoffs To Avoid Ratings Pressure Amid The COVID-19 Pandemic

As many sectors face unprecedented disruption related to demand contraction and turbulent credit markets, our utility analysts are actively engaging with the companies we rate to discuss potential challenges utility management teams face.

Listen: US power sector known for reliability, contingency planning faces challenges from coronavirus

Scott Aaronson, vice president of security and preparedness for the Edison Electric Institute, talks with Jasmin Melvin of S&P Global Platts about emergency preparedness for utilities and the challenges ahead for the industry.

Recovery

Fossil fuel-exposed utilities could be poised for a coronavirus rebound

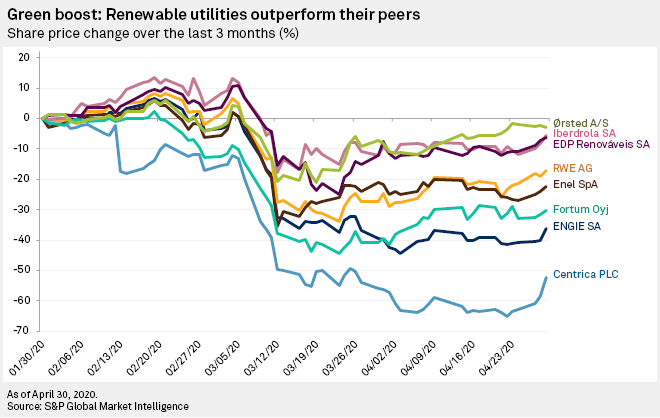

With pure-play renewable utilities outperforming their more diversified peers on stock markets in Europe amid a coronavirus-induced sell-off, fossil fuel generators hit by lower power prices and retail suppliers coping with a demand crunch could be set for a rebound.

COVID-19 To Dim, But Not Darken, Brazilian Electric Utilities' Operations

Despite projected lower operating cash flows in the short to medium term because of the social-distancing measures and lower power demand stemming from the economic downturn, S&P Global Ratings expects ratings on Brazilian electric utilities to remain mostly unaffected.

Credit

Regulatory Responses To COVID-19 Are Key To Utilities’ Credit Prospects

The COVID-19 pandemic has created an unprecedented level of uncertainty and regulatory action in North America. Throughout the United States and Canada, many state and provincial governments have instituted mandatory moratoriums on utilities shutting off customers, or they have worked together to institute voluntary moratoriums during the COVID-19 pandemic.

These moratoriums, along with any lost revenues due to the economic impact of COVID-19 pandemic and the potential incurrence of higher operating expenses, may weaken financial measures of utilities. S&P Global Ratings has been monitoring these actions and their impact on credit quality of U.S. and Canadian regulated utilities.

Live Webinar and Q&A: Power Markets’ Outlook And Credit Implications In The Age Of COVID-19

Reductions in electricity demand and economic activity in US and Europe to mitigate the COVID-19 pandemic will change the landscape for current power markets and could challenge the rapidly expanding green electricity segment.

Join S&P Global analysts from Platts, Market Intelligence and Ratings for an early review of implications for power markets, the energy transition and the credit quality for power generators.

View Webinar Replay

Unemployment

Certain State Unemployment Rates May Indicate Utilities With Most Revenue Risk

The 2020 unemployment data for each of the 50 states and the District of Columbia is summarized in the below map.

As Pandemic-Related Disconnection Moratoriums End, Talk Turns to Unpaid Bills

Whether by choice or by obligation, many electric utilities instituted disconnection moratoriums in response to the coronavirus pandemic, providing financially struggling households with some temporary economic relief.

But with many of those moratoriums soon set to expire and the nation's economy still far from fully recovered from the effects of COVID-19, a portion of those with deferred utility bills likely remain unable to pay their accumulated debts.

Read the Full Article

Economic Implications

COVID-19: While Most Of The U.S. Is Shut Down, Utilities Are Open For Business

S&P Global economists forecast U.S. GDP will contract 5.2% in 2020 and headline unemployment could reach 19% in May, even with an economic recovery beginning in the third quarter of 2020 (An Already Historic U.S. Downturn Now Looks Even Worse, April 16, 2020).

Can Canadian Regulated Utilities Sustain 2019 Improvements Amid COVID-19 And An Oil Price Slump?

Most Canadian investor-owned utilities (IOUs), including Algonquin Power & Utilities Corp., AltaGas Ltd., ATCO Ltd., Emera Inc., Fortis Inc., and Hydro One Ltd., improved their business and/or financial risk profiles in 2019.

However, the current COVID-19 pandemic and the oil price crash in recent months have spurred an economic recession.

Read the Full Article

Budget Impacts

Virus-induced recession, city budget crunches could squeeze public utilities

A recession caused by restrictions to control the coronavirus is likely to put pressure on U.S. public power utilities as cities grapple with budget shortfalls and struggling customers foreclose options such as rate increases or service disconnections.

Government-affiliated utilities have historically been "very stable and largely immune to pronounced effects from changing economic conditions" due to their consistent financial performance and typically autonomous rate-setting authority, S&P Global Ratings credit analyst David Bodek said.

COVID-19 Related Obstacles Could Give Pause To Utility Capital Expenditure Plans

While expectations remain high that considerable levels of capital expenditures will continue to support utility profit expansion in coming years.

Natural Gas

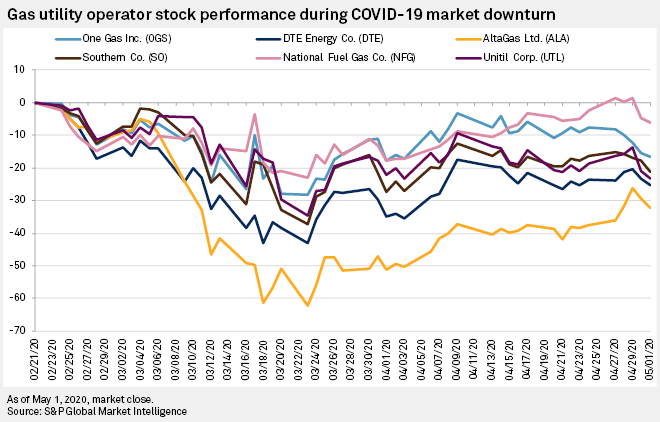

Small, midcap gas utilities raise more coronavirus concerns than larger peers

Small and midsize natural gas utilities issued revenue, profit and capital spending warnings linked to the coronavirus outbreak, while their bigger peers largely shrugged off the pandemic's potential impacts on their gas business.

Gas utility industry looks beyond pandemic to multiyear strategic focus

Confident in their ability to weather the coronavirus pandemic, gas utilities have turned their focus to long-term strategy, executives told the financial community during a virtual gathering.

AGA President and CEO Karen Harbert kicked off the event, an annual meetup that moved online following the outbreak, by outlining the trade group's three goals for navigating the outbreak and associated government restrictions and economic downturn.

The first was to make sure gas utility workers were deemed essential to ensure they could move freely through their territories and access personal protective equipment from government stockpiles.

Read the Full Article

Earnings

US utilities raise $20.3B in March, YTD figure reaches $33.74B

U.S. electric, gas and water utilities raised a total of $20.30 billion in March, with roughly $19.87 billion coming from senior debt offerings, according to S&P Global Market Intelligence data. The accumulated year-to-date capital raised by the sector, as of March 31, was $33.74 billion.

Berkshire Hathaway Energy issued $3.25 billion, including $1.1 billion of its 3.700% senior notes, $900 million of 4.250% senior notes and $1.25 billion in 4.05% senior notes. The company planned to use the proceeds to refinance short-term debt.

Utility, Broad Market Valuations Narrow As Pessimism Eases Ahead Of Q1 Earnings

Valuations across the energy and water utility sectors improved on a stock price-to-earnings plus growth basis, led by the multi-utility group's average 32% rise since our March 24 valuation analysis.

Mergers & Acquisitions

In Era Of Social Distancing, Most Utilities Unlikely To Embrace Mergers In 2020

The impact of COVID-19 is expected to be felt on the utility sector for quite some time. The uncertainty associated with the pandemic has roiled the financial markets in recent weeks and has altered the focus of many utilities.

The likelihood of new large electric and natural gas utility mergers and acquisitions being announced in the near future has diminished significantly.

Water Investors Focused On Capex, Consumption Trends And Acquisition Pipeline

On upcoming conference calls, traditional first quarter results are likely to be a secondary concern for water utility investors.

The focus will instead center on the impact of COVID-19 on capital spending programs, recent changes in customer consumption patterns, and the pipeline of municipal acquisitions.

Read the Full Article

Policy and Regulations

Utility regulators have 'no rules of the road' for addressing coronavirus

The coronavirus pandemic has presented utility regulators with a set of obstacles they have never before confronted, challenging them to adapt regulatory tools to balance the interests of ratepayers struggling through unemployment and gas distributors juggling unanticipated costs and lost revenues.

Key Takeaways

- Analysts say the proliferation of new regulatory mechanisms since the Great Recession will help smooth out revenue and cost swings that would otherwise require new rate cases.

- Regulatory innovations could reduce the need for new rate cases to address potential recession impacts.

- Analysts and consumer groups also agree that many low-income ratepayers may never be able to repay their gas bills, raising the question of how to deal with the bad debt utilities will accrue from nonpayment.

- In New York, the epicenter of the U.S. coronavirus outbreak, stakeholders are also petitioning the state's Public Service Commission, or PSC, to take broad steps to ease the burden on ratepayers.