Subscribe to start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

SUBSCRIBE TO THE NEWSLETTERSGlobal Impact of Inflation

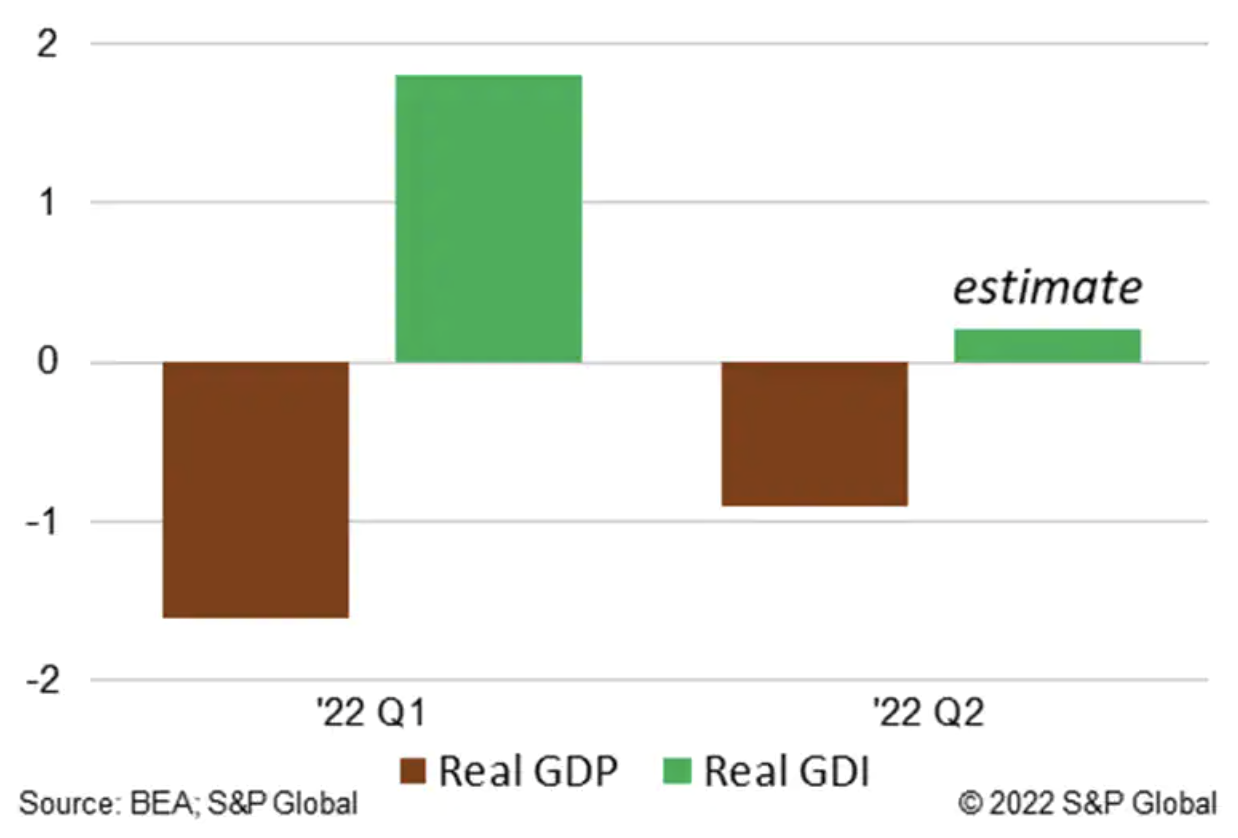

Did The U.S. Economy Contract Over The First Half Of 2022? It’s A Tale Of Two Measures

On July 28 the Bureau of Economic Analysis (BEA) reported that the nation's inflation-adjusted (or "real") Gross Domestic Product (GDP) fell at a 0.9% annual rate in the second quarter (Q2). This follows a decline of 1.6% in Q1, thereby satisfying the popular—although not the official—definition of a recession. But did the economy actually contract over the first half of the year?

Alternative Measures of First-Half Economic Growth (Percent Change Annual Rate)

Inflation And Rate Hits Won't Knock Out India Inc.

India's companies and banks could feel the bite of rising rates and inflation. Credit profiles could deteriorate for up to 20% of Indian corporate debt, according to our stress test of more than 800 (mostly unrated) companies in India, representing US$570 billion in debt.

Read the ReportInflation and Unrest in Sub-Saharan Africa

Inflation in developed economies and in the sub-Saharan African region has accelerated quite significantly. Central banks responded and in most instances policy rates have been adjusted upward to stem the price pressures.

Read the ArticleWith Inflation Cresting, the Global Economy Can Achieve a Soft Landing

Two shocks pushed the economy off course in the second quarter—Russia's invasion of Ukraine on 24 February and COVID-19 lockdowns in mainland China.

Read the ArticleThe RatingsXpress: Macroeconomics dataset includes S&P Global Ratings Macroeconomic conditions. This dataset provides historic and forecast data provided by S&P Global Ratings on major economic indicators covering CPI, employment, GDP, balance of payments, trade, consumption, and government spending.

Access MoreFood & Agriculture

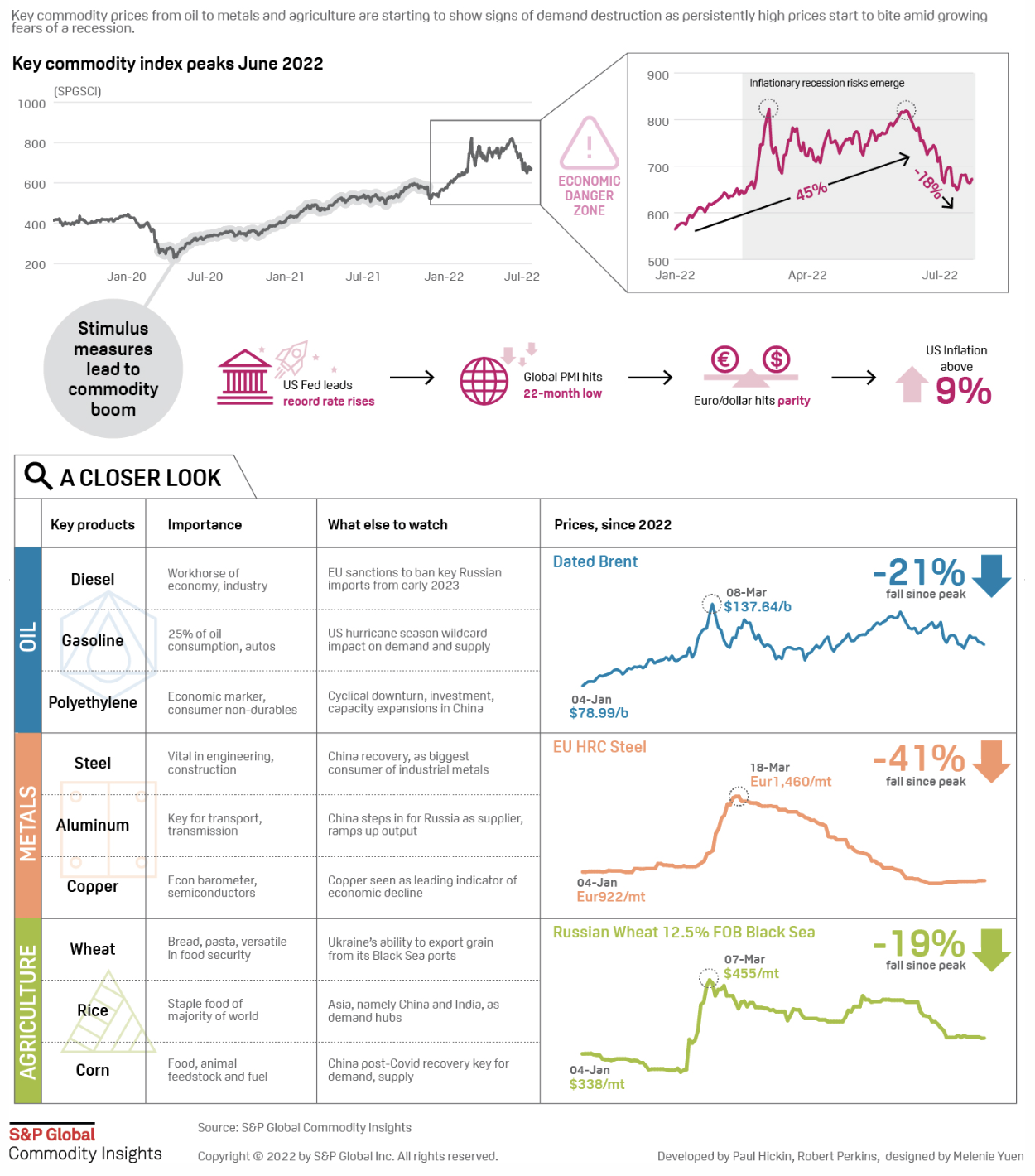

Fuel For Thought: Commodity Supercycle Theory Will Struggle To Pass Ultimate Economic Test

The commodity market boom is over. Energy, metals, and agriculture prices have all tumbled from their March peak on inflationary recession fears amid a slew of economic warning signs, but a commodity bust is far from inevitable.

Since early 2020, more and more analysts have been championing the idea of a new commodity supercycle, with an economic recovery turbo-charged by low interest and pandemic-led fiscal stimulus measures, and as investment into decarbonization projects accelerated to meet net-zero targets.

Demand Destruction in Focus as Inflation Hits

How Will Canadian Grocers Digest Inflation?

Food inflation was up 8.8% in the 12 months ended June 30, 2022. Canadian grocery retailers will be among the retail subsectors most affected in 2022.

Read the ArticleSpecial Report: Food & Agricultural Commodity Inflation

The U.S. Consumer Price Index (CPI), the broadest measure of inflation at the consumer level, has maintained near 8.5% for three consecutive months, the highest level since 1981.

Read the ArticleMixed Impacts Across The Food Sector As Inflation Hits Consumer Spending

Consumers are changing their spending habits as prices continue to rise for food and other consumer goods. In a series of recent investor communications, food, retail and FMCG companies report consumers are prioritizing food and other essentials as inflation eats into household budgets.

Read the ArticleU.S. vs Eurozone Food Inflation

Annual U.S. food price inflation reached 10.1% in May, while a similar measure for the Eurozone registered 8.9%. Although the figures of 10.1% and 8.9% suggest food price inflation is nearing similar levels in the U.S. and Europe, a closer look shows two different inflation pictures on each side of the Atlantic.

Read the ArticleSupply Chain and Inflation

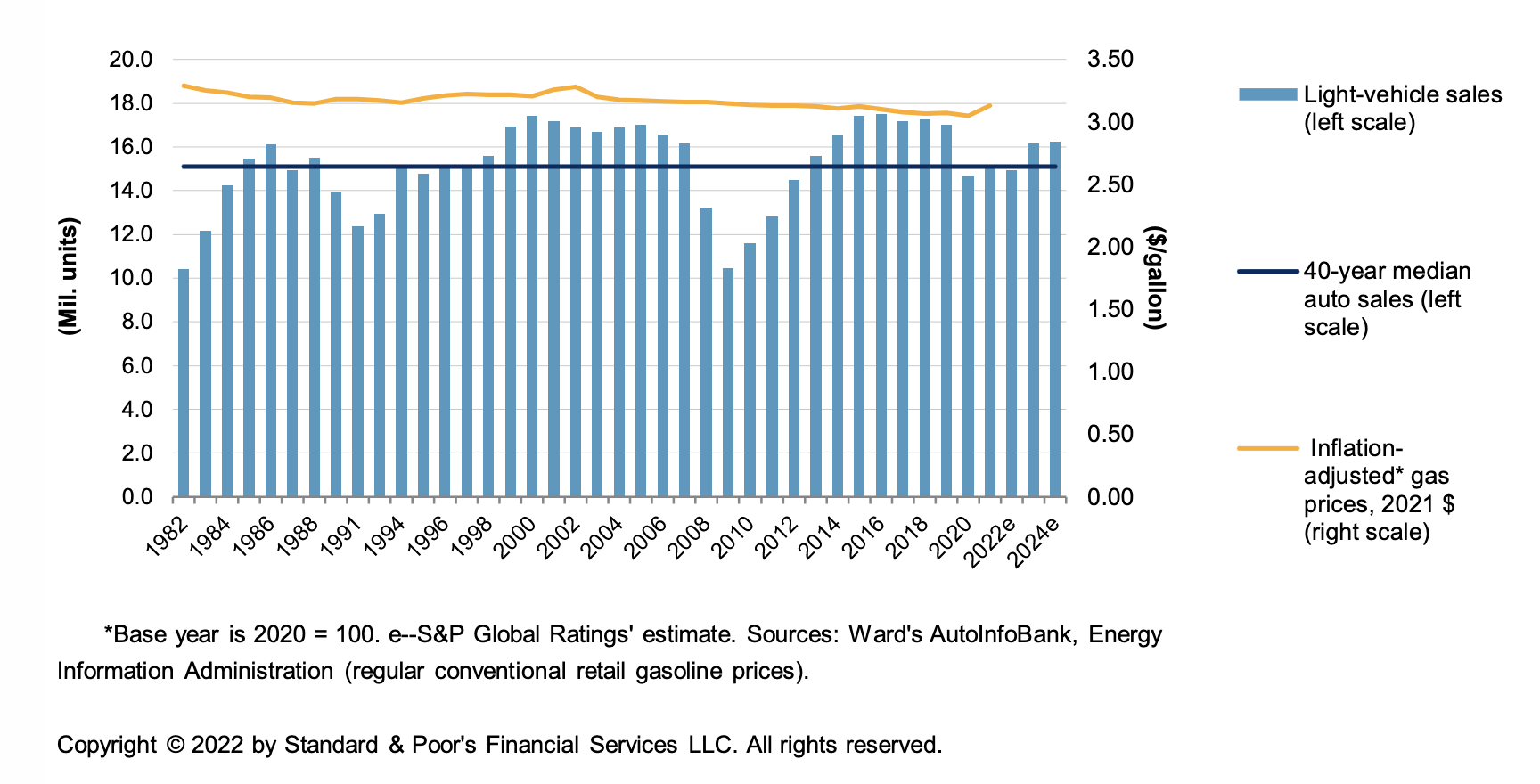

U.S. Auto Companies Face A Tough Road Ahead With Persistent Supply Challenges And Weakening Macro Conditions

Supply bottlenecks amid steady demand will create a marginal decline in light-vehicle sales in 2022 versus 2021 and affordability risks could curb pent-up demand in 2023.

U.S. Light-Vehicle Sales (1982-2022 Estimate)

As Inventories Disappear, New Vehicle Monthly Payments Surge

With June 2022 industry 'number of days supply' coming in at 26 days, the industry now has experienced an unprecedented 14 consecutive months of inventories below a 30-day supply. "Normal" inventories are usually in the 55-65 days range, so a drop below 30 days for just one month would be extraordinary. For such a shortage to continue for over a year is unheard of.

Read the ArticleCredit Trends: Elevated Inflation And Supply Chain Constraints Threaten Potential Credit Improvement

Following 22 consecutive months of contraction, the gap between potential downgrades and potential upgrades has tightened to a record low of just 13 as of May 31, 2022.

Read the ArticleEnergy Prices and Inflation

Oil And Gas Prices Fuel U.S. Mineral-Producing States' Coffers As Economic Momentum Slows

On the tail of elevated oil and natural gas prices, mineral-producing states' severance taxes and mineral royalties are surging, although the inflationary pressures they have in part caused could stymie broader economic momentum across other sectors.

Oil and gas-producing states are poised to lead economic (real gross state product [GSP]) growth in calendar 2023, with seven ranking among the top-15 for real GSP growth nationally after a sluggish 2022.

Among the eight states surveyed, forecast median GSP growth is 75 basis points (bps) and 16 bps higher than the median growth rate for all states in 2023 and 2024, respectively.

Mining sector employment remains well below levels from a decade ago despite an uptick in mining activities following the onset of the pandemic. Regional economies that rely more heavily on mining activities will likely experience the most benefit from increased production and high prices, though sector concentration poses longer-term credit risks when boom cycles turn to bust.

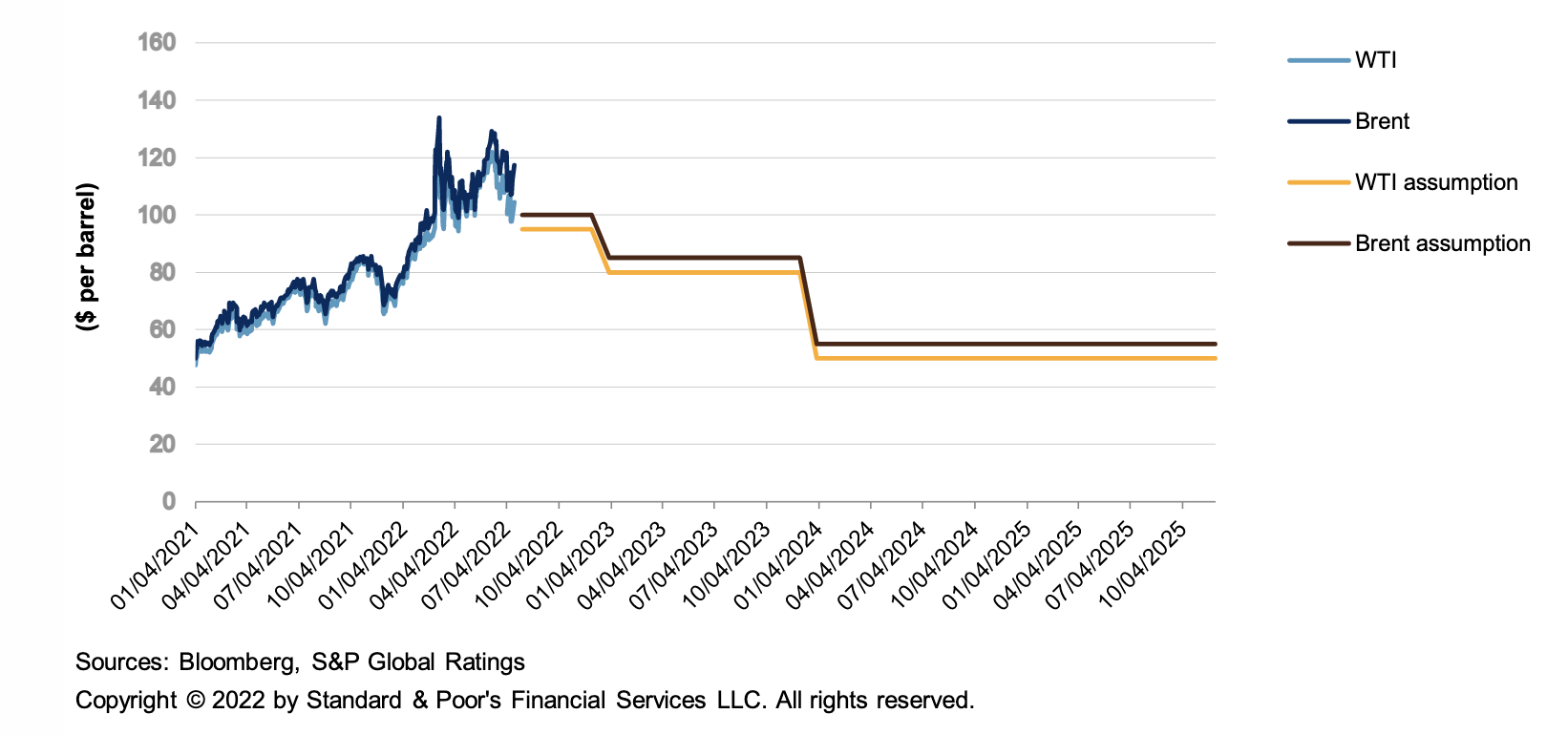

West Texas Intermediate and Brent Crude Oil Price

Mining Companies Pressured by Inflation in 1st Half of 2022

Rising costs for labor, energy and equipment and continued supply chain constraints created a snowball effect of complications for mining companies in the second quarter.

Read the ArticleU.K. Adults Cut Back on Oil Products, Gas, Electricity Use as Costs Rise: Data

More evidence of demand destruction in advanced economies emerged Aug. 5 when a closely watched survey of consumer habits by the Office of National Statistics showed that 42% of adults in the UK had cut back on non-essential travel in vehicles in response to higher costs.

Read the ArticleHigh Gas Prices Make Renewable Energy More Competitive, Even Without Tax Credits: Nextera

Despite the US Congress' failure to extend tax credits for renewables, NextEra Energy executives said July 22 they were confident that renewable energy will be a competitive option for the foreseeable future as high natural gas prices are expected to remain elevated.

Read the ArticleA collection of pre-calculated global equity selection signals. These signals, or factors, each represent a simple investment strategy supported by academic or industry research.

ACCESS MOREAsk An Expert

Global Manufacturing Price Inflation Cools To One-And-A-Half-Year Low

Inflationary pressures in the worldwide factory sector moderated to the lowest for a year-and-a-half in July, according to the latest JPMorgan Manufacturing Purchasing Managers' Index™ (PMI™), compiled by S&P Global. The reduced rate of increase primarily reflected an easing of global supply chain constraints, linked in turn to weakening demand for raw materials and destocking.

However, the overall rate of inflation signaled for both input costs and average selling prices remained elevated, with persistent upward pressure on costs resulting from an unprecedented broad-based upswing in wage pressures as well as high energy and shipping costs.