Subscribe to start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

SUBSCRIBE TO THE NEWSLETTERSFinancial Markets

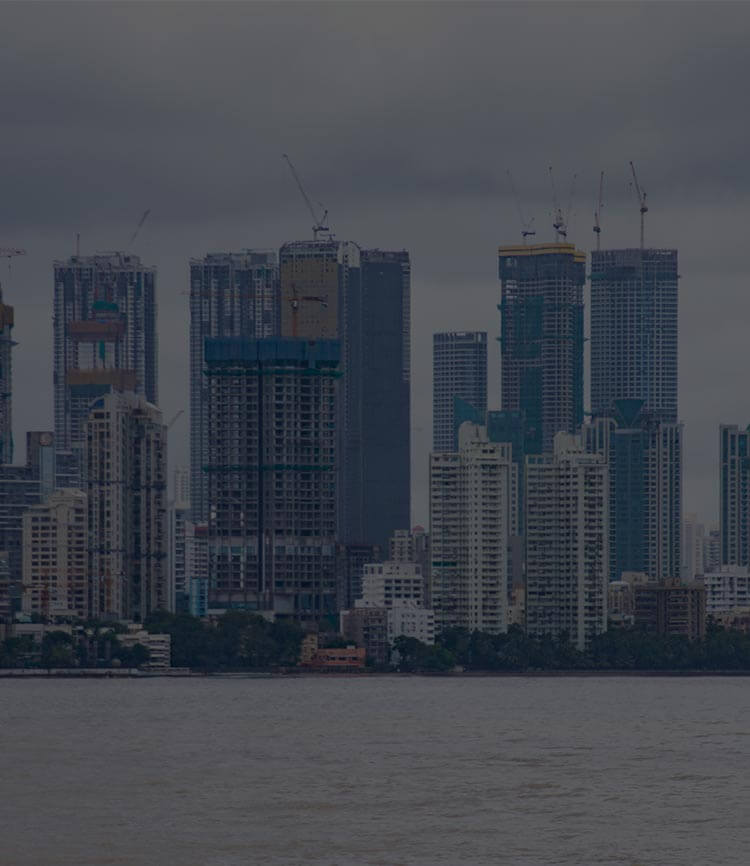

Indian Banks' Profits Set To Grow More As Rates Rise, Nonperforming Loans Fall

Indian banks are likely to see their profits improve further in the current fiscal year that started April 1, as they benefit from rising interest rates, declining nonperforming loans, and higher loan growth.

Financial Highlights of India’s Largest Private and Public Banks

Indian Banks To Raise Bond Funds To Lock In Low Rates Before Window Closes

Indian banks are likely to jump into the bond market as surging global inflation and a surprise rise in interest rates spur concerns about the outlook for borrowing costs.

Banks may rush to raise money for mortgage books and long-term infrastructure projects before rates climb higher, said Anand Dama, a senior analyst at financial services research firm Emkay Global.

HDFC Bank's Merger With Parent To Create Indian Mortgage Powerhouse

The proposed merger of India's leading mortgage lender with the nation's biggest private-sector bank will create a financial services powerhouse with economies of scale and the ability to raise funds at competitive rates.

HDFC Bank Ltd. said April 4 that it will merge with its parent, Housing Development Finance Corp. Ltd., to grow its home loans portfolio as housing demand is poised to drive the Indian economy.

Energy

India's Ambitious Gasoline-Ethanol Blending Plan Has Price, Supply Woes To Overcome

Surging crude prices have prompted India to set an ambitious goal of achieving 20% ethanol blending in gasoline, a move analysts said could help to cut the ballooning oil import bill, although ensuring plentiful availability of the biofuel at viable prices would be a key challenge.

The recent pledge by New Delhi to advance the 20% blending target -- 20% ethanol and 80% gasoline -- by five years to fiscal year 2025-26 (April-March) from 2030 is the latest policy measure that India has announced to find ways to battle high oil prices that have pushed up the inflation rate to eight-year highs.

However, analysts said lifting the biofuel blending rate with gasoline from the current 10% to 20% in such a short span of time may be possible only in certain pockets of the country but not across the entire country.

"The major sugarcane and ethanol production regions of Uttar Pradesh, Maharashtra and Karnataka should be able to meet this new mandate," said Loren Puette, biofuels analyst at Platts Analytics of S&P Global Commodity Insights.

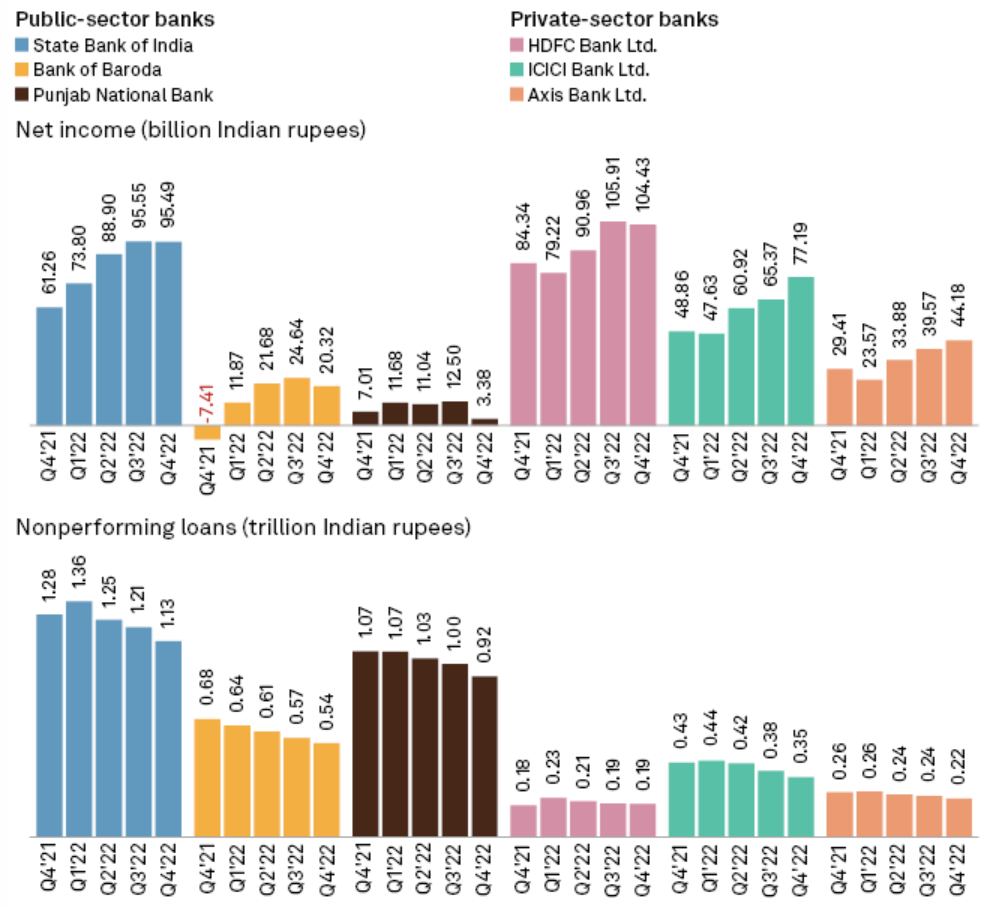

India’s Long-Term Gasoline Demand Outlook Positive Despite Energy Transition

India Plans To Reduce Power Output From 81 Coal Plants, Replace With Green Energy

India's federal power ministry plans to reduce power generation from 81 thermal coal-fired plants over the next four years, as part of its efforts to switch to clean energy sources and cut carbon emissions, according to a letter seen by S&P Global Commodity Insights May 30.

READ THE ARTICLEIndia Aims To Ease Oil Price Pain Through Tax Cuts, New Term Crude Deals

From cutting taxes on retail oil products to scouting around for attractive term crude deals, India is stepping up efforts to ensure that surging world prices do not stand in the way of the fragile economic recovery as well as a revival in domestic oil product consumption.

READ THE ARTICLESurging Prices Hold Back India's Oil Demand Growth Momentum, Albeit Temporarily

India's sustained uptrend in oil consumption came to a halt and slipped into the red in April from March levels as rising domestic retail fuel prices on the back of surging crude took a toll on gasoline, diesel and LPG demand, but analysts said the trend could get reversed in May.

READ THE ARTICLEIn a complicated world where one event triggers challenges for seemingly unrelated industries, the S&P Global network of over 750 global experts can provide you a 360-degree view of key trends. Get in-depth insights into the intersection of topics such as economics, shipping, automotive, commodities trading, oil and gas, financials, sustainability and more.

FIND AN EXPERTMetals & Mining

5 Key Drivers Of India’s Protracted Coal Crunch

India is continuing to grapple with a severe and protracted power crisis after a sustained surge in global coal prices in late-2021 was further aggravated by Russia's invasion of Ukraine in February.

The global price pressure eroded India's import volumes and reduced its power plant stockpiles to critically low levels just as an unrelenting heat wave pushed demand to unprecedented levels. The country generates more than 75% of its power from coal, and is the world's third-largest producer of electricity at 1,383 TWh/year.

The crisis is so severe that government authorities in India – the world's second-largest coal producer, importer and consumer after China – are threatening to cut domestic coal supply to power plants that are reluctant to import coal at current elevated prices.

But how did it get to this?

The current deficit, the second such coal shortage since October 2021, was initially triggered by the sharp rise in global coal prices in mid-2021.

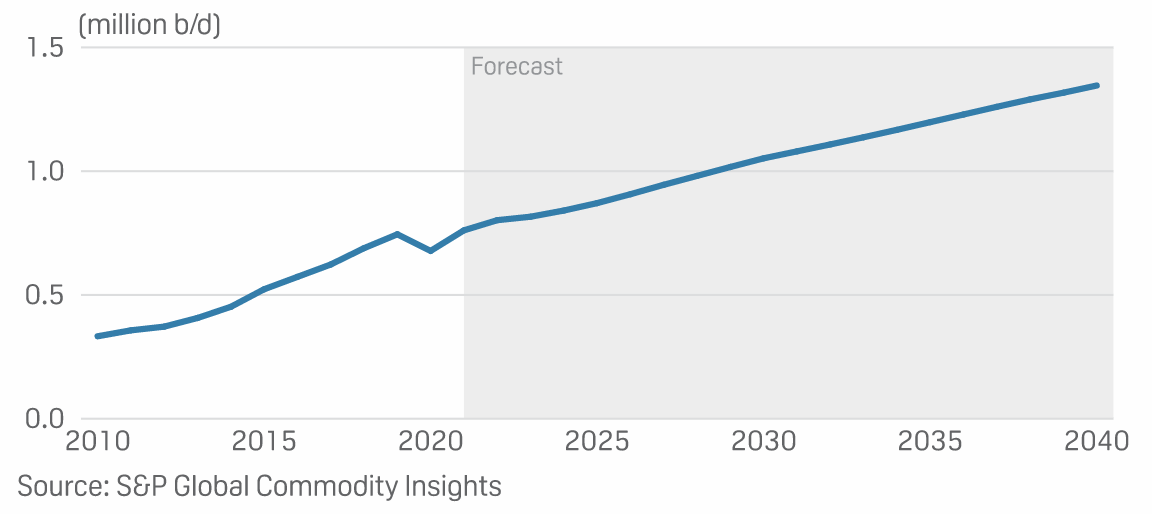

Indonesia and Australia Contributed Around Two-Thirds of Indian Coal Imports in 2021

Indian Steel Fraternity Livid Over Unexpected, Steep Export Tariffs

India's sudden and unexpected revision of export duties on steel products is likely to result in short-term uncertainty and long-term structural ramifications on global steel markets, sources told S&P Global Commodity Insights May 23.

READ THE ARTICLEIndia Raises Export Duty On Iron Ore, Chinese Reception Mixed

India has raised export duties of iron ore raw materials in an attempt to reduce the cost of domestic steel production, according to a notification released by the country's Ministry of Finance May 21.

READ THE ARTICLEIndia's Insatiable Power Appetite To Keep Coal Relevant For Decades: GE Power India MD

The share of coal in India's power generation will fall from 74% to about 54% by 2030, but the exponential growth in the size of the country's power market would mean that the sector would still be consuming more coal 10 years from now than at present, Prashant Jain, managing director of GE Power India Ltd., told S&P Global Commodity Insights.

READ THE ARTICLEAccess CRISIL's unparalled indepth coverage on Credit Ratings for CRISIL rated Indian companies along with analytical inputs on rating drivers and details on lenders.

ACCESS MORE:Agriculture

India Likely To Clear Up To 1 Mil Mt Wheat Exports Under Allowed Exemptions

India is likely to allow wheat exports of up to 1 million mt within the next few days as part of exemptions to its ban on wheat shipments, multiple officials from the country's Ministry of Commerce and Industry told S&P Global Commodity Insights May 27.

India banned wheat exports on May 13 amid rising domestic inflation and a fall in output. The government had reduced the wheat output estimates for marketing year 2022-23 (April-May) by 5 million mt on May 19 from 111.4 million mt projected in February. The revised output would be around 3% lower on the year.

In its notification announcing the export ban, the government had also exempted shipments under contracts where letters of credit were issued on or before May 13. The soon-to-be-announced clearance for shipments is expected under this exemption, they added.

"Around half of the shipments are to go to Bangladesh largely by railways and roadways," an official with the trade ministry added.

India Allows Wheat Loading For Some Pending Contracts; Australia Wheat FOB Prices Slip

India's customs authority has permitted four vessels to resume loading the balance of their wheat cargoes in a document dated May 17 seen by S&P Global Commodity Insights.

On May 13, India had banned wheat exports to maintain domestic availability of the food grain and check rising prices.

India's Wheat Export Ban Pushes Australian FOB Price To Record High

India's wheat export ban announced May 13 to ensure sufficient availability of wheat in domestic markets pushed the Australian wheat price to a record high May 17.

READ THE ARTICLE