Discover more about S&P Global’s offerings

The path to net-zero must span global economies, resources and technologies.

Published: January 10, 2024

A single, global energy transition path is unrealistic and counterproductive to the goals of reaching net-zero.

Energy security and affordability trump energy transition when lives and livelihoods are at stake.

The math of carbon budgets and climate change is unforgiving; however, so is the math of connecting about 800 million people with no access to electricity.

Fast-paced deployment of clean energy technologies globally offers a promise that emissions will start to decline this decade.

Developments over the past two years have demonstrated that the energy transition is more complicated than previously thought. While the transition proceeds, expectations of a linear global shift have been shaken as climate goals compete with priorities around energy security, energy access and affordability.

A series of shocks, crises and tensions in the global energy system point to the need for an equitable transition that is inclusive of different situations in different parts of the world and that reflects a diversity of policy approaches.

The energy price spike that began in late summer/early fall 2021 pushed affordability to the fore, leading to policy challenges in many countries. Described by some as “the first energy crisis of the energy transition,” it resulted from a mismatch of strong demand growth and underinvestment in conventional supplies.

The disruption in energy markets arising from Russia’s 2022 invasion of Ukraine — high prices, shortages, a cost-of-living crisis, economic dislocation — reinforced the affordability challenge and put energy security back on the table as a central concern for governments and the public alike. There is now an increased risk that high energy costs will undermine public support for policies and investments backing the transition to a low-carbon economy.

The emergence of a new North-South divide between the wealthy countries of the Global North and the developing countries of the Global South has fostered an increasingly sharp debate over the cost and timing of the energy transition, its relative burdens and its compatibility with other priorities such as economic growth, poverty reduction and improved health.

The trilemma of energy security, affordability and sustainability looks very different in Africa, Latin America and the developing countries of Asia than in Europe and the US, where per capita incomes are as much as 40 times higher. This divergence makes addressing the gaps in policy, technology and financing a significant challenge across geographies.

There are also issues related to the supply chains needed for net-zero. Beginning around 2021 and continuing today, a host of governments — the US, the UK, Japan, Canada and the EU — and entities — the World Bank, the International Monetary Fund and the International Energy Agency — have raised concerns over the adequacy of mineral supply and processing capacity to meet the needs of rapidly growing industries such as renewable power and electric vehicles. These supply chain issues are further complicated by rising geopolitical tensions.

For developing economies, which already face high borrowing costs for energy projects, rocketing interest rates make it even more difficult to develop commercially viable projects and attract investors.

Finally, there is an unfolding shock of a different kind — the end of cheap money. Central banks have continued to raise interest rates to tackle stubbornly high inflation. High interest rates raise the cost of capital for all energy investments. For developing economies, which already face high borrowing costs for energy projects, rocketing interest rates make it even more difficult to develop commercially viable projects and attract investors. Higher interest rates also raise holding costs, resulting in potentially lower inventories of oil and risking more volatility.

These issues, along with a growing sense of urgency from the general body of climate science, are part of the evolving framework of the energy transition — which, despite its complexity, continues to gain political momentum.

have continued to raise interest rates to tackle stubbornly high inflation. High interest rates raise the cost of capital for all energy investments. For developing economies, which already face high borrowing costs for energy projects, rocketing interest rates make it even more difficult to develop commercially viable projects and attract investors. Higher interest rates also raise holding costs, resulting in potentially lower inventories of oil and risking more volatility.

Policy actions in the US and the EU have cemented net-zero ambitions, with the launch of the Inflation Reduction Act in the US and the REPowerEU plan in Europe. The former has been described as generational in its impact. Meanwhile, China’s investment in the energy transition continues to outpace all others, driven by a quest for national security linked to reducing its dependence on imported oil and gas.

However, the realities of the global energy system and the diverse status of global economies represent challenges to meeting these goals.

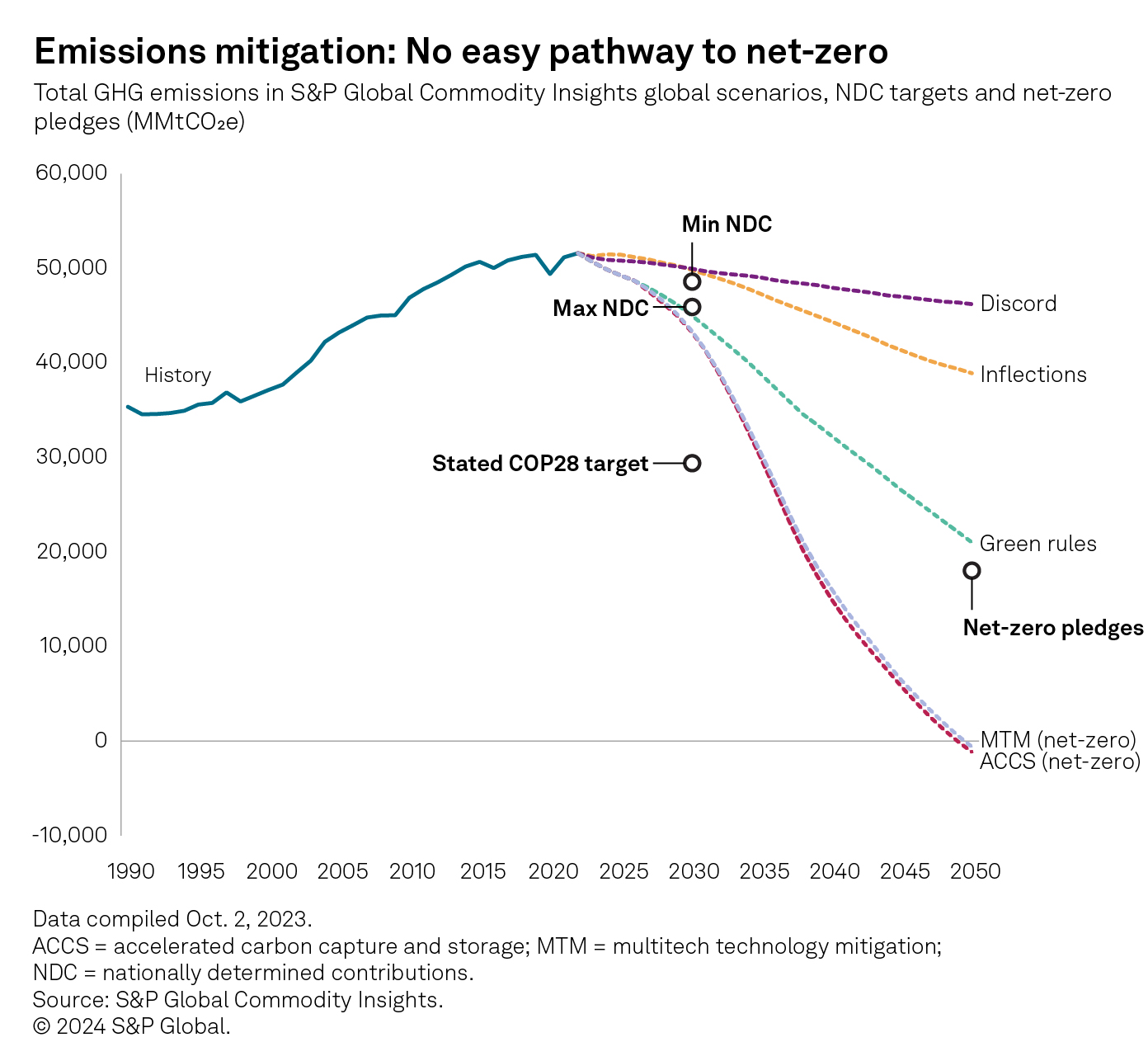

According to S&P Global Commodity Insights, current nationally determined contributions would reduce global emissions by only 10% in 2030 relative to 2019 levels. This compares with the 43% reduction that the Intergovernmental Panel on Climate Change set as the benchmark to align with a 1.5 degrees C pathway.

Despite a rise in climate ambitions and supporting policies, in the last 30 years, the share of hydrocarbons in the global primary energy mix has hardly changed, to 80% from 81%. Global greenhouse gas emissions are estimated to have increased 0.9% in 2022, hitting a new record of 52 gigatonnes. Energy demand has continued to grow in most emerging and developing economies as hundreds of millions more people with increased access to reliable and affordable energy have achieved improved living standards.

The challenge is how to bend the emissions curve while ensuring economic growth. The climate policies of the Global North will be insufficient to achieve the global goal of net-zero unless there are reductions in emissions from fast-growing developing economies.

The challenge is how to bend the emissions curve while ensuring economic growth.

The widening gap between current emissions trajectories and the pathway required to achieve net-zero by 2050 is illustrated by emissions scenarios developed independently by the International Energy Agency and S&P Global Commodity Insights.1

In large measure, closing this gap will depend on scaling low-carbon technologies. According to S&P Global Commodity Insights, investment in renewable power and energy storage amounted to about $477 billion in 2022 and will average $700 billion per year through 2030 — with most investments centered on a handful of regions: China, the EU and North America.

S&P Global data shows that 301 GW of new renewable power was installed in 2022.2

S&P Global expects that 70% to 75% of the new generating capacity installed between 2023 and 2050 will be renewable power.

Progress is being registered on large-scale battery storage to enable this growing share of variable power to become baseload power. The rollout of EVs is also accelerating. In the first half of 2023, 28% of new cars sold in China were EVs, with 19% in Europe and 9% in the US.3

Hydrogen, which was hardly on the agenda half a decade ago, has become a major target for investment and projects, and biofuels and renewable natural gas are also gaining greater scale. Technology advances, government support, regulation and growing private sector support — all of these will continue to pave the path ahead.

Next Article:

The journey to further EV adoption

1IEA NZE 2022 and S&P MTM and ACCS scenarios are back cast from a 1.5 degree C objective, i.e., what would be required to achieve this goal? Other scenarios are forward projections based on current or anticipated changes to policies and markets.

2Renewable power includes solar PV/CSP, onshore/offshore wind, biomass and waste, geothermal, ocean and other renewables.

3See S&P Global Commodity Insights’ “Pulse of Change: Monthly BEV and PHEV sales update,” July 6, 2023. Includes BEV and PHEV cars. Sales data compiled for January–May 2023, except for the US, where data is available for January–April 2023.

This article was authored by a cross-section of representatives from S&P Global and in certain circumstances external guest authors. The views expressed are those of the authors and do not necessarily reflect the views or positions of any entities they represent and are not necessarily reflected in the products and services those entities offer. This research is a publication of S&P Global and does not comment on current or future credit ratings or credit rating methodologies.